In a prior blog post I pointed out that creating a financial statement is a collaboration between many parties which exist both within your organization and some of which are external to your organization.

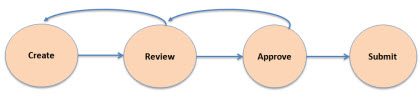

In this blog post I want to point out that there is a workflow which exists when creating a financial statement. Here is a very simplified workflow: create, review, approve, submit.

Clearly one can dig deeper into the many, many details of the workflow of creating a financial statement. The point here though is to simply point out that one should be thinking about workflow when considering software for creating SEC XBRL financial filings.

Clearly one can dig deeper into the many, many details of the workflow of creating a financial statement. The point here though is to simply point out that one should be thinking about workflow when considering software for creating SEC XBRL financial filings.

Further, workflow can be determined by the fundamental approach one chooses for getting their SEC XBRL financial filing created. Popular categories of approaches (which are covered in chapter 11 of XBRL for Dummies) include:

- Bolt on: You basically "bolt on" another process for generating the XBRL to an existing process of creating the Word and HTML versions of your SEC filing. Typically one might purchase an additional software product to generate your XBRL output.

- Out source: Outsourcing is really somewhat of a bolt on approach except that rather than purchasing software which adds the additional needed functionality of generating XBRL, you out source the entire process.

- Integrated: Integrating the creation of the Word, HTML, and XBRL formats into one process is another approach to getting that XBRL generated. This generally involves purchasing new software which offers XBRL generation or updating to a new version of an existing software product which you use which offers the feature of XBRL output.

- "Roll your own" solution: A type of integrated approach is for you to "roll your own" solution by either creating internal systems which generate XBRL or somehow enhancing the functionality of a third party software product which you use. For example, this article discusses United Technologies use of XBRL.

If you were around when the PC was first introduced, you will recall that initially PCs had a character-based interface. Think "DOS". That all changed with the introduction of the graphical user interface by Apple on its first Mac. Not everyone believed that the graphical user interface provided an improvement over the DOS character based interface. But Apple proved the graphical user interface and the user interface paradigm shifted.

A similar paradigm shift will occur with SEC XBRL financial filing software. If you really consider workflow; the common approaches used today where someone bolts on an additional process or outsourcing the process of generating the required XBRL does little to improve the overall financial statement creation process. That is why accountants see little value in XBRL today.

When work flow is considered and appropriate software is created the value accountants will see from XBRL and what XBRL enables will change. When will this change take place? In my view the change is already occurring slowly but surely. The pace will become more rapid over next year, I predict.

Further, I predict that accountants will be using XBRL enabled semantic, structured, model-based authoring software products for creating financial statements whether they need to submit XBRL to some regulator or bank, or not. Why? Because the workflow enabled by technologies such as XBRL will enable more effecient and effective processes.