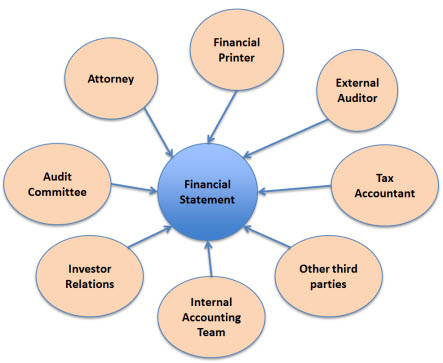

The creation of an external financial statement is a collaboration between multiple parties. This collaboration is both inter- and intra-organization. The graphic below shows many of the parties which collaborate to create an external financial statement.

Before the internet existed, many of the means of collaboration we take for granted today were either simply impossible or cost prohibitive for all but the largest organizations. As such, collaboration could be considered "efficient" by pre-internet standards. However, by today's standards with the capabilities enabled because of the internet, those same efficient looking processes seem quite inefficient.

Before the internet collaboration with external parties took the form of the postal service, the fax, couriers, etc. Even collaboration with internal parties required these types of resources. Today, we all know that this is different and that anything which is in a digital form or can be put into a digital form can be anywhere on the planet in milliseconds.

But, if you look at the process of creating an external financial statement, how efficient is it? This how Ventana Research describes the process in their white paper Selecting the Right XBRL Solution (2008, page 5):

All larger companies keep the text and numbers that go into their external reports in multiple enterprise systems and a large number of spreadsheets (usually Microsoft Excel) and text documents created with word processing software (such as Microsoft Word) scattered around on individual hard drives and multiple network directories. People cobble together filings from a large number of text files and spreadsheets in a highly manual, time-consuming and error-prone process.

Gartner tells a similar story in their research report XBRL Will Enhance Corporate Disclosure and Corporate Performance Management (April 23, 2008):

For example, it is estimated that the average Fortune 1000 company used more than 800 spreadsheets to prepare its financial statements for regulatory reporting.

And that describes the internal collaborative process. One would anticipate that the method of collaborating with external participants in this process is similar or likely even worse.

Is there a better way?

The primary objective of XBRL is to enable one business system to exchange information with another business system without the involvement of the IT department. The IT department can exchange information between systems with one hand tied behind their back. But when you get the IT department involved, costs go up. Plus, without standards the costs go up because all you can build is point solutions which allows interoperability between two systems. Standards, like XBRL, offer general interoperability.

Are we there yet with XBRL? Not quite, but getting closer. Today business system interoperability is easier because of standards such as XBRL. But, you still need that IT department to help out. Proof of this is the high number of SEC XBRL filers who out source this task.

But in the future there will be better business system interoperability, achieving the interoperability will be easier, and not only will the internal collaboration be easier; but collaboration with external parties will likewise be easier. Costs will be reduced. Applying a "bolt on" process, even if that bolt on process is out sourced, simply adds more work.

In a future post I will like at some of the specific types of collaborations involved in external financial reporting and how XBRL and other technologies can enable significant improvements in not only efficiency but also in effectiveness.

So stay tuned!