I adopted a mantra awhile back: "The only thing better than metadata is more metadata."

Over the years I have collected metadata, did my best to figure out how to express this metadata, reorganized the metadata, read some good books about metadata, experimented with metadata, and otherwise tried to put the pieces of financial reporting metadata together that I was interested in. Why? I believe in Tim Berners-Lee linked data vision.

Third order of order will contribute to making XBRL useful in ways most people don't even imagine at this point in time. I have pointed out this statement by David Weinberger, author of Everything is Miscellaneous, and it is worth pointing out again:

In fact, the third-order practices that make a company's existing assets more profitable, increase customer loyalty, and seriously reduce costs are the Trojan horse of the information age. As we all get used to them, third-order practices undermine some of our most deeply ingrained ways of thinking about the world and our knowledge of it.

Here is some experimenting I have been doing. A financial report is made up of pieces. These pieces can be categorized:

- Primary Financial Statements

- Organization, Consolidation, and Presentation of Financial Statements

- Significant Accounting Policies

- Financial Statement Accounts Disclosures

- Basis of Reporting

- Broad Transactional Categories Disclosures

- Industry Specific Disclosures

- Document and Entity Information

- Supplementary Information

Writing that list down on paper or using "electronic paper" like this blog is helpful. Putting the that information into a database is even more helpful. For example, here is that same list from a query of a relational database. Even more useful is expressing that list using a form such as RDF/OWL which is readable by any system which speaks the language of the internet: HTTP and XML. Here is that same list in RDF/OWL.

While that list of major categories is helpful, having the next level of information is also helpful. The Accounting Standards Codification (ASC) calls these topics. Here is that list of financial reporting topics from a relational database query, and again in RDF/OWL.

Drilling in a little deeper, for each topic there are a number of disclosures which reporting entities make about that topic. I call these disclosure objects. I have identified 1,145 disclosure objects in the US GAAP Taxonomy and SEC XBRL financial filings. Clearly this is not a complete list, there are others. Here is my list of disclosure objects from a relational database, and here is the same list in RDF/OWL. Note that you can filter the list of disclosure objects using the major categories and topics defined above. See how useful metadata is? So, here is a list of the disclosure objects relating to the major category "primary financial statements" and the topic "balance sheet". And this list relates to the major category "basis of reporting" and "earnings per share".

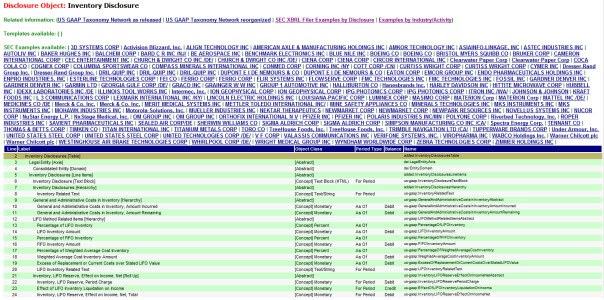

If you look on the right side of the list, you see a link to a prototype of the disclosure object. For example, if you go to the major category "financial statements account disclosures" and select the topic "inventory" (click here to do so), and then you click on the first item on the list which is "Inventory Disclosure" (where it says "HTML" on the right hand side, or click here) you see something which looks like the screen shot below:

If you explore that HTML page, you will see that you can get to the US GAAP Taxonomy piece which has that disclosure, a reorganized version of the US GAAP taxonomy which also has it, two viewers which let you explore SEC filings which provide that disclosure, direct links to numerous SEC filings which contain that disclosure, and a handy list of common report elements which are used to create that disclosure.

All these things are hooked together by the name of the disclosure object.

How useful is that? There are lots of other things one can link to. For every financial report elemental, you can get to the definition of the pieces of the disclosure, references to the accounting standards codification and other information complements of the US GAAP taxonomy. If you have a subscription to the ASC, you can navigate directly to the FASB site. Eventually, the FASB will recognize that they need to make the ASC available as a web service so the ASC can be used directly inside applications used to create financial reports.

All of these pieces has existed in the past, but it was impossible to hook them all together effectively because the information was in different books, physical links were therefore not possible; humans linked these things together, going to the different resources as they needed them, if they had the resource. The internet is a web of all these resources. Metadata hooks the pieces together.