The primary cause of errors in XBRL-based financial filings boils down to two things:

- US GAAP XBRL Taxonomy inconsistency

- US GAAP XBRL Taxonomy ambiguity or lack of explicitness/intention

Those are the problems from the evidence that I observe. Everything else is a symptom of those two things. These two fundamental issues causes software to be created incorrectly, causes the SEC to have to write EFM rules to overcome these issues, and unnecessary complexity and confusion for public companies having to create XBRL-based financial filings.

To understand what I am saying and how I reached this conclusion; take a look at a very simple analysis of four required disclosures: nature of business, basis of reporting, significant accounting policies, and revenue recognition policy.

You can go walk through the details of the analysis yourself. But allow me to walk you through the big picture. Keep in the back of your mind that a taxonomy such is supposed to be a formal, well-thought-out representation of information.

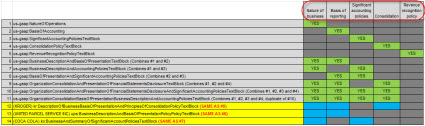

First, consider this matrix: (click on the image for a larger view)

In the matrix you see four required disclosures and one very, very common disclosure in the column headings: nature of business, basis of reporting, significant accounting policies, consolidation, and revenue recognition policy.

In the rows of the matrix; rows 1 to 5 provide concepts from the US GAAP XBRL Taxonomy which reporting entities can use to represent that information in their XBRL-based financial filing. Rows 6 to 11 provide various combinations of those concepts which likewise can be used to represent that information. Rows 12 to 14 show extension concepts created by filers to represent information.

My analysis looks at how Fortune 100 companies represent this information: nature of business, basis of reporting, significant accounting policies and revenue recognition policy. Of the 100 public companies, 53 of them conform to all of what I would have expected. That leaves 47 who do not for one reason or another. If a reporting entity misses one detail, it is considered nonconforming. All other reporting entities are considered conforming. So, 53% of reporting entities get everything correct.

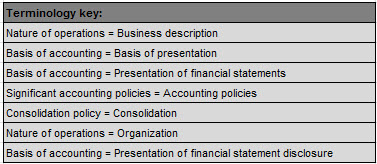

Consider the following terminology reconciliation:

Go back and look at the matrix. Look at the inconsistency in the terminology the US GAAP XBRL Taxonomy uses. There is zero reason for this sort of inconsistency. For example, while reporting entities might refer to something as "nature of business" or "nature of operations" or "business description" or "organization" or perhaps a handful of other terms; the US GAAP XBRL Taxonomy really should be using exactly ONE term. I happened to pick "Nature of business". The US GAAP XBRL Taxonomy could pick some other term. Does not matter what term. But they should pick it and stick with that term consistently. This may seem like a very simple thing, and it is pretty basic. But you would be surprised of how much of this sort of inconsistency exists in the US GAAP XBRL Taxonomy and the problems that the inconsistency causes in terms of concept duplication, difficulty in using the taxonomy, general confusion, complexity, and so forth.

Secondly, the fact that a concept such as "Organization, Consolidation and Presentation of Financial Statements Disclosure and Significant Accounting Policies [Text Block]" even exists shows a fundamental flaw in the orientation of those building and maintaining the taxonomy. That one US GAAP XBRL Taxonomy concept represents four distinct disclosures. It may not seem like it because of the inconsistency issue. But read the definition/documentation of that concept:

The entire disclosure for the organization, consolidation and basis of presentation of financial statements disclosure, and significant accounting policies of the reporting entity.

That is a presentation oriented view of the information reported. This is the disclosure oriented view:

- Nature of Operations [Text Block]: The entire disclosure for the nature of an entity's business, major products or services, principal markets including location, and the relative importance of its operations in each business and the basis for the determination, including but not limited to, assets, revenues, or earnings.

- Consolidation, Policy [Policy Text Block]: Disclosure of accounting policy regarding (1) the principles it follows in consolidating or combining the separate financial statements, including the principles followed in determining the inclusion or exclusion of subsidiaries or other entities in the consolidated or combined financial statements and (2) its treatment of interests in other entities.

- Basis of Accounting [Text Block]: The entire disclosure for the basis of accounting, or basis of presentation, used to prepare the financial statements.

- Significant Accounting Policies [Text Block]: The entire disclosure for all significant accounting policies of the reporting entity.

There is zero probability that the US GAAP XBRL Taxonomy could ever provide every permutation of the combinations of possible concepts a every reporting entity could come up with. Attempting to do so makes the taxonomy significantly more complicated and complex to make use of. But heck, if the folks at the FASB do want to take this approach, then they should at least use consistent terminology.

It could very well be the case that it was a conscious choice to in the short term take the approach of leading public companies to believe that all possible presentational combinations would be included in the US GAAP XBRL Taxonomy. The reality is that it is harder to describe how to use the US GAAP XBRL Taxonomy if you have to explain all these convoluted options which are available.

For example, consider this analysis of PACCAR. I am not picking on PACCAR, I just happened to pick that example. Here is there filing so you can go to the SEC EDGAR system and look at this yourself.

PACCAR clearly provides a nature of business disclosure. They call it "Description of Operations". You can see it in the significant accounting policies disclosure, which PACCAR provides. But they created an extension concept, pcar:NatureOfOperationsPolicyTextBlock, to report what should have been reported using the concept us-gaap:NatureOfOperations based on that concepts definition/documentation. Now, a lot of filers put the nature of business information within the consolidation policy concept, us-gaap:ConsolidationPolicyTextBlock, so my algorithm to find these disclosures considers that concept. This need for a mapping causes complexity in making use of the information, and in my case here an error interpreting the reported information. Everything else for PACCAR is fine.

Go look through the conforming and nonconforming Fortune 100 reporting entities. You can project what you see onto the other 6900 reporting entities and the 1000 or so other disclosures. This is a fairly straight forward disclosure requirement, their really is nothing particularly hard here. Yet, you try to sort this out in your own mind or try to explain this to someone or otherwise determine what is correct and what is incorrect can be maddening. Simple is hard to create. I am not saying it is easy. But, it is necessary.

Fixing US GAAP XBRL Taxonomy issues such as these will reduce errors. Many filer errors are symptoms of the problem of inconsistency. Other are a symptom of not being explicit, such as not providing explicity business rules preferably in a machine readable format.

Both consistency and explicit intention are things software vendors can leverage to make XBRL-based digital financial reporting easier for SEC filers.