NOTE: Subsequent to this post I detected an error in a query and obtained more reliable information for XBRL technical syntax and EFM errors. These changes yielded in increase in the number of digital financial all stars to a total of 1,281. Supporting information has been updated to reflect these updates.

Using digital financial reports should not be a guessing game. I spent almost a year poking and prodding SEC XBRL financial filings (fiscal year 2012 10-Ks) trying to make use of the information these digital financial reports contain. I arrived at a set of minimum criteria for making use of any reported information. There was one goal: safe, reliable, predictable, automated reuse of reported financial information.

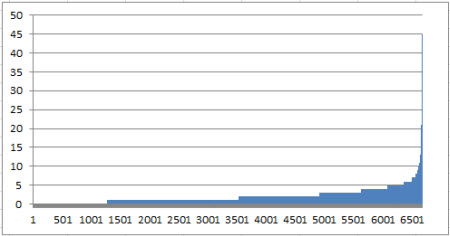

I used these criteria against 10-Ks filed with the SEC between March 1, 2013 and February 28, 2014, basically for fiscal year 2013. There were a total of 6,674 SEC XBRL financial filings that I worked with after deleting a handful of trusts, funky CIK numbers, and a few other odd but rare things.

Of the total of 6,674 SEC XBRL financial filings, there were 915 digital financial reporting all stars which meet all seven of the minimum criteria. These digital financial reporting all stars represents about 14% of all SEC XBRL financial filings.

For the curious, those who want to see for themselves and those who might want to reverse engineer what is going on, I provided some additional stuff.

All the data for these SEC XBRL financial filings is made available in this ZIPPED Excel file. Also, another ZIPPED Excel file provides an application which extracts the fundamental accounting concepts from the SEC XBRL financial filing. A list of the digital financial reporting all stars which provides for safe, reliable, predictable, automated reuse is provides so you can check those out.

Also provided are lists of each filing which does NOT meet one or more specific criteria. This allows one to see the impact on trying to use this information. Plus, I have provided one analysis thus far (I will provide more) to show the specific reasonsSEC XBRL financial filings do not pass these minimum criteria. This first analysis is basic, test BS2 - Assets = Liabilities and Equity (i.e. balance sheets balance). The analysis captures 8 specific reasons why balance sheets do not balance in SEC XBRL financial filings.

What is wrong if an SEC XBRL financial filing does not pass one of these rules? There are exactly three possibilities:

- The SEC XBRL financial filing has a mistake and should be adjusted.

- The minimum criteria have a mistake, a rule is wrong, and the rule needs to be changed.

- The software algorithm has a mistake and the algorithm must be changed to correct for the mistake.

What is the point? For every issue one of those three things needs to happen to bring the system into equilibrium, to bring the system into balance. Which is it? Which needs to be changed? Well that is up to the financial reporting supply chain to determine.

While there are 915 digital reporting all stars which offer state-of-the-art digital financial reports, these numbers are even more interesting:

- 915 SEC XBRL financial filings have 0 errors as pointed out about, they are all stars. (This was revised upward to 1281)

- 2250 SEC filings have 1 error. (revised to 2293)

- 1382 have 2 errors.

- 714 have 3 errors. (revised to 700)

- 465 have 4 errors. (revised to 433)

- 275 have 5 errors. (revised to 255)

- 5086 SEC XBRL financial filings are 5 of fewer errors from becoming digital financial reporting all stars. That is 76% of the total. (That would give us 14% plus 76% or 90% all stars.) (revised to be 6344 and 95% of filings have 5 of fewer errors)

- 66 SEC XBRL financial filings have between 10 and 45 errors. (revised to be 330 with between 6 and 316 errors)

There are a total of 13,181 specific errors/issues/anomalies, call them what you want. That is an average of about 2 per SEC filing.

Granted, this is not saying that correcting these 13,181 issues will create 100% correct SEC XBRL financial filings, that is not what I am saying. This is only a minimum threshold level of information use. But it will create a nice beach head: primary financial statement information for the default legal entity.

In my view establishing this beach head allows for two important things: (1) A base of information use, (2) a path forward, building on that base.