The latest information related to fundamental accounting concepts is consistent with the prior analysis set. This latest information is based on a 100% automated assessment of 6,674 fiscal year end public company financial filings (10-Ks) submitted to the SEC between March 1, 2013 and February 28, 2014.

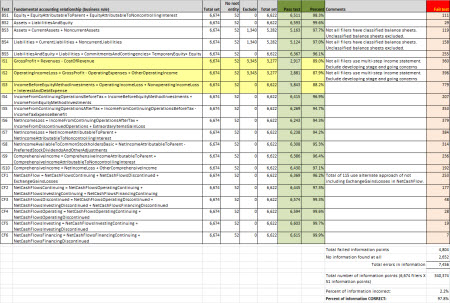

This is a summary of the results:

- 51 fundamental concepts were sought

- 21 relations between those concepts were tested, these relations are never expected to change

- On average 97.8% of reported facts within SEC XBRL financial filings fit within these concepts and relations (in the prior year's analysis it was 97.9%)

- For the total of 21 tests, 18 tests have passing rates between 94% and 99%

- For the total of 21 tests, 3 tests have passing rates between 87% and 89%

- For each of the 21 tests, there are specific reasons an SEC XBRL financial filing does not pass the test, for example this document explains the specific reasons 29 filings do not pass test B2 (Assets = Liabilities and Equity)

- At least 1,281 or 19% of all 6,674 SEC filings analyzed report all 51 fundamental accounting concepts and adhere to the 21 relations between those concepts

- This Excel application let you review all filings which pass and fail these tests.

This graphic breaks down the results into categories: (click image for larger view)

Identifying these fundamental accounting concepts and attempting to extract this information from SEC XBRL financial filings provide a number of noteworthy insights.

- Insight #1: If an SEC XBRL financial filing does not pass one of these tests exactly one of three things is incorrect: (a) the SEC XBRL financial filings, (b) the test, or (c) the software algorithm used to obtain the reported information.

- Insight #2: These fundamental accounting concepts and the relations between the concepts provide a "skeleton" into which all information must fit. If each of these fundamental concepts cannot be either specifically identified as being reported or imputed based on other information then the report is at best untrustworthy and likely ambiguous and at worst unsafe to use or completely unusable.

- Insight #3: Each and every one of these fundamental accounting concept and relations between the concepts appears necessary. What I mean by this is that a test of a relation cannot simply be dropped. For example, I was tempted to drop the three tests which had passing rates of less than 90%. But you cannot do that because if those relations are not intact the "skeleton" will fall apart. The tests appear to be a set of simultaneous equations or linear equations which are tightly related.

- Insight #4: Related to insight #2, when an SEC XBRL financial filing uses a concept intended for one fundamental accounting concept category into some other category, bad things happen. Using the skeleton analogy it is like if someone takes a bone which was intended to be on the hand and uses it on the foot, things break. What this means is that categories of concepts should not be crossed.

- Insight #5: Understanding the reasons why SEC XBRL financial filings reported facts cannot be discovered is important for establishing both specific an general rules for reporting and consuming reported information to keep using reported information from being a guessing game. For example, this document shows that of 29 SEC XBRL financial filings which have balance sheets that don't balance, 9 were caused by what could be considered "rounding errors" (i.e. perhaps an acceptable tolerance). This begs the question: Are rounding errors allowed? 6665 SEC filings don't have such rounding errors, are these 9 acceptable? Are rounding errors, or tolerances, acceptable or appropriate in other areas or is it best that these rounding errors be eliminated when reports are created (as most filers seem to do)?

Check out all the data for yourself, see what conclusions you come up with. If you come up with additional insights please let me know what you come up with.

Here is a comparison of the fundamental accounting concepts of the DOW 30 provided by SECXBRL.info.