Every accountant knows that assets should foot. So should liabilities and equity. Net income (loss) on the income statement foots. Net cash flow on the cash flow statement foots. Further, SEC Edger Filer Manual (EFM) rules, 6.15.2, requires that these computations be provided with SEC XBRL financial filings in the form of XBRL calculation relations.

90.1% of SEC XBRL financial filings provide these XBRL calcuations for these primary financial statement roll up computations. Pretty straight forward. This document Understanding Why Roll Ups are Missing provides what helps you understand how to see if required XBRL calculation relations are missing from SEC XBRL financial filings which support the validation/verification of these primary financial roll ups which always exist in financial statements.

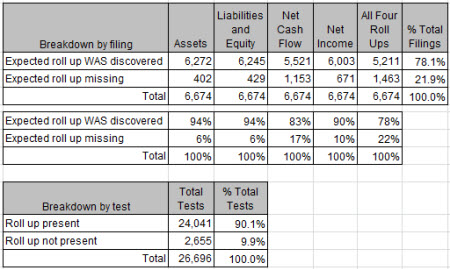

There is something which is important to understand. I will point this out for the roll up computations but this relates to all these tests. Consider this graphic which will help explain the point:

There are two ways you can view these tests: by filing and by test. If you look at this by filing, then if you don't have any one of the four roll ups, then you fail the test. If you look at this by test, each individual roll up is considered and if you have three of the four, you get "credit" for three.

I point this out so you can use this information to look at this information. There is no real right or wrong answer, you just need to understand what the information means.

This is my summary of key insights:

Insight #1: Balance sheets report assets, liabilities and equity; assets foot; liabilities and equity foots. Income statements report net income (loss); that foots as well. Cash flow statement report net cash flow; and that foots as well.

Insight #2: If you are looking at this basic financial information and you can verify that these roll up computations work as expected, your trust of the information when you send it to some automated process, which might do a comparison or something, can be much higher because everything seems to work as you expect.

Insight #3: Each of these roll up computations is required by SEC EFM rules.

Insight #4: There is no "technical" reason that these XBRL calculations cannot be expressed and verified to be consistent. If someone thinks there is some reason they cannot express these correctly and therefore they leave them out, they make a mistake in their representation of the information in XBRL. If the representation mistake is corrected, then the XBRL calculations can work correctly.