The quality of public company XBRL-based digital financial reports continues to increase. There are two significant trends. First, between 2013 and 2014 overall consistency with all the rules in a set of 21 fundamental accounting concept relationship rules grew to 58.3% from the comparable overall consistency of 25.6% a year ago.

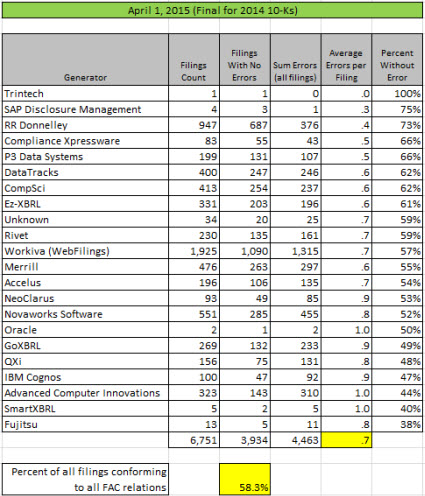

The second trend is that you can see an increasing spread between the quality levels between generators, the software vendors and filing agents which are used to create these XBRL-based digital financial reports. Here is a summary of the current results (for 2014 10-K filings):

(Click image for a larger view)

(Click image for a larger view)

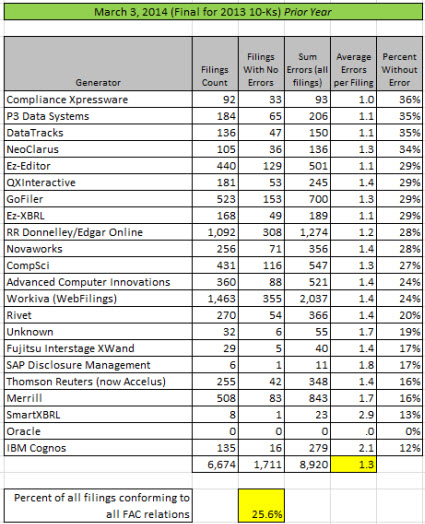

Here is comparible information for 2013 public company 10-Ks:

So look at the differences in the percentages of generators (software vendors/filing agents) in being consistent with these 22 fundamental accounting concept relations. Ask yourself a question: Why would there be a difference between consistency with those relations by generator? Something to think about.

There are three reasons why these numbers change:

- Correction of filing errors in the reports of public companies which are not consistent with the specified rules.

- Correction of rule errors in the fundamental accounting concept relation rules and therefore in the verification check results.

- Correction of US GAAP XBRL Taxonomy errors which can make it impossible for public companies to represent their report information consistent with the relation rules because of missing concepts.

All of the rules which are used to specify the fundamental accounting concept relations can be found here in the report frames (report pallets) which express the fundamental accounting concept relations.

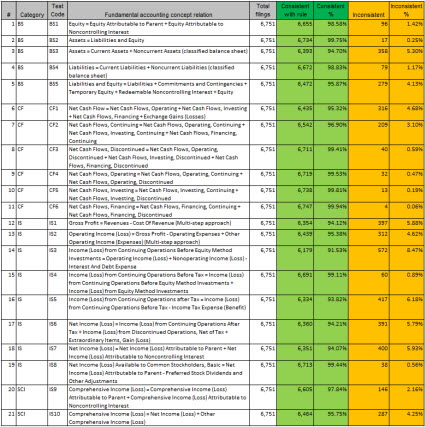

The following is a summary of the consistency of public company XBRL-based digital financial reports to the fundamental accounting concept relations for each relation. As can be seen in the data, public companies financial reports are over 90% consistent with every relation and 95% consistent with all but 5 relations. Average consistency to these relations is 96.9%.

One very significant change between the prior year and the current year is that the current 2014 information comes from off-the-shelf commercial software which is available. In 2013, the software was not commercially available.

More details will be provided in the near future. (Here are those details.)