In a prior post I pointed out that the quality of public company XBRL-based financial filings doubled with respect to consistency with a set of fundamental accounting concept relations. Measurement is key attaining quality.

"Quality is never an accident; it is always the result of high intention, sincere effort, intelligent direction and skillful execution…."

- Will A. Foster, Business Executive

Arriving at 2014 Digital Financial Reporting All Stars: Summary walks you through how that quality is measured. This resource helps you understand what is necessary for a machine to read reported financial information and successfully make use of that information. The resource also helps to understand how to correct these quality issues.

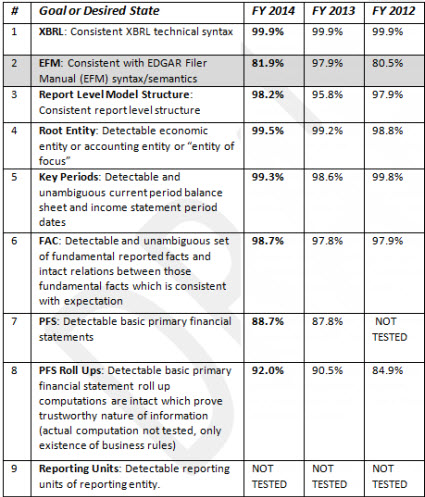

I call these steps the minimum criteria necessary to make use of XBRL-based reported financial information. This is a summary of those minimum criteria (also included in the document):

The document walks you through how consistent XBRL-based public company financial filings to the SEC are with these criteria and information which helps you better understand the details of each criteria.

The good news is that the quality of public company XBRL-based financial filings continue to increase. Overall, 3,356 or 50% of all such digital financial reports are consistent with these basic minimum criteria. What is even better is that another 1,729 are only 1 issue away from consistency with all these criteria. That would bring 75% of all filings consistent with all of these minimum criteria. Only 5 issues or less per stand between public company financial filing and 98.77% consistency with all of these minimum criteria.

As is said, if you cannot measure it you cannot control it.

While these minimum criteria are far from what is sufficient to make 100% of the information within public company XBRL-based digital financial reports; they are necessary. The minimum criteria is both a start and helps one understand the path to quality XBRL-based financial information and successful information reuse.

For more information useful in understanding and correcting these issues, please see this resouce.