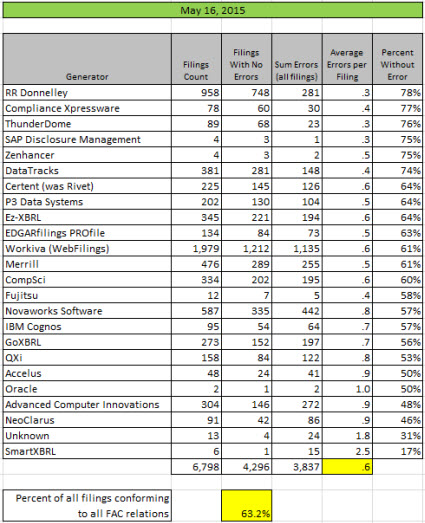

The quality of public company XBRL-based financial reports submitted to the SEC continues to improve. The last measurement of a specific set of fundamental accounting concept relations showed that 58% of all such public company financial reports were consistent with expected basic accounting relations. That consistency rate has increased 5% to 63%. The average number of inconsistencies per financial report (for my set of relations) has decreased from .7 per report to .6. The total number of inconsistencies dropped by 626.

This is the summary of information by software vendor and/or filing agent (generator):

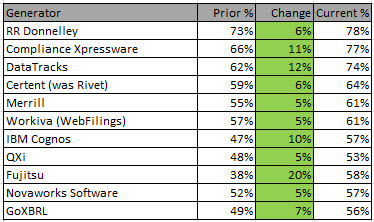

There were 11 software vendors/filing agents that had a 5% increase in quality or greater as compared to my prior analysis in April 2015.

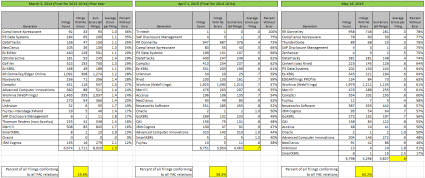

This graphic shows comparison information for the 2013 10-K season, the 2014 10-K season, and this most current analysis:

Competition is a good thing. Public companies have plenty of options when it comes to software vendors and/or filing agents for helping them create their digital financial reports. These choices will help push quality even higher, I believe, and will help the financial reporting supply chain achieve what other domains such as health care and electronic medical records are trying to achieve.

Want to understand how to improve your consistency with these basic fundamental accounting concept relations? This chapter of Digital Financial Reporting provides information about the fundamental accounting concepts. This page on my blog provided very detailed information on these accounting relations. If you want to understand the bigger picture, I suggest these two resources: Digital Financial Reporting Principles and Knowledge Engineering Basics for Professional Accountants.

I will measure quality again in three months. I predict that there will be another healthy increase in quality, that over two thirds of all public company XBRL-based financial filings to the SEC will be consistent with all of these basic accounting relations, and that at least four software vendors/filing agents will have 80% of their financial filings or more completely consistent with these basic accounting relations.