A financial report is a type of the more general business report. A financial report is “bounded” by the rules of double-entry accounting. That is what differentiates a financial report (bounded by the double-entry accounting model) from a business report (NOT bound by the double-entry accounting model).

The basic high-level model of double-entry accounting is described by the accounting equation which is a logical statement:

Assets = Liabilities + Equity

Standards setters create financial reporting schemes . Within those financial reporting schemes, the standards setter expands on the accounting equation in slightly different ways per the specific needs of that specific financial reporting scheme. But by definition a standards setter cannot violate the accounting equation. These rules that essentially expand the accounting equation tend to be outlined along with other important information within a conceptual framework for that financial reporting scheme. The financial reporting scheme essentially defines a core set of classes of elements used by that financial reporting scheme which reconciles to the accounting equation.

The elements of financial statements are the building blocks, or classes of defined elements, with which financial statements are constructed by an economic entity reporting per some financial reporting scheme.

The items in the financial statements of a specific economic entity represent in words and numbers certain entity resources, claims against those resources, and the effects of transactions and events, circumstances, and other phenomenon that result in changes in those resources and claims.

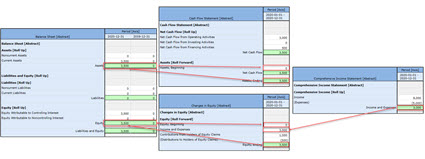

These classes of building blocks are intentionally interrelated mathematically within the four core statements that make up a financial report; this is called 'articulation'.

Intermediate components, i.e. subtotals, can be used to represent the items of an economic entity within the items that comprise a financial report of the economic entity. However, these intermediate components and the items must fit into the core framework of the classes of elements that are the building blocks of a any financial report created using a specific reporting scheme.

The high-level model of a financial report and double-entry accounting can be represented within the XBRL technical syntax and then used to both explain a financial report model and verify that the financial report model is consistent with that explanation.

I have done exactly this for US GAAP, IFRS, and FRF for SMEs so far. Others are coming soon.

The four primary financial statements form the high-level structure of a financial report. Many other things in the report must fit into that core structure.

The balance sheet provides a roll up of assets, a roll up of liabilities and equity, and is bound by the rule “Assets = Liabilities + Equity”. The income statement is used to compute the roll up total “Net Income” and there are rules for how the intermediate components (i.e. subtotals) of Net Income roll up. Net income then flows to the statement of changes in equity which is a roll forward which reconciles beginning and ending equity on the current and prior balance sheets. The cash flow statement is a roll up of Net Cash Flow, rules that specify how the intermediate components (i.e. subtotals) of net cash flow roll up, and a roll forward of the asset Cash and Cash Equivalents which reconciles the beginning and ending balance of that asset on the balance sheet.

While the model shown above which is based on “Assets = Liabilities and Equity”; some economic entities use different sorts of models. For example, some economic entities report using a liquidation basis style balance sheet where “Assets - Liabilities = Net Assets”. “Net Assets” and “Equity” are two different labels for what is the same concept.

Using the rules of mathematics, the equation “Assets = Liabilities + Equity” can be converted to “Assets - Liabilities = Equity”.

So, while a financial report is not a static form it is not random either. Financial reports follow patterns and these patterns can be explained using specific models to account for and manage the variability inherent in a financial report. Each set of items in the financial report of an economic entity must follow the accounting equation and the elements of a financial statement defined by some financial reporting scheme.

About 90% of XBRL-based financial reports submitted to the SEC using US GAAP follow what one might expect. About 10% don't. Software needs to make it so that professional accountants creating such reports succeed in getting 100% of such representations correct.