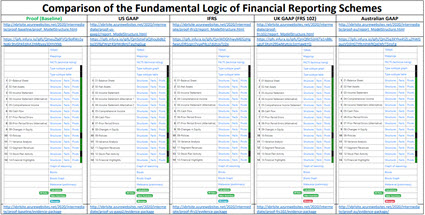

I did this comparison of financial reporting schemes in another blog post. This blog post tunes and enhances that prior comparison.

At the heart of Pacioli which was created by Auditchain lies a new unifying logical perspective upon financial reports.

Here is what I mean. Look at the graphic below (here is the document that contains the graph and more details). Consider the following and as you do have a look at the GREEN bars on the Pacioli summary page that show that EVERY financial reporting scheme can consistently represent the same logic within their XBRL taxonomy (or SHOULD be able to). Consider:

- Is a roll up different in US GAAP, IFRS, UK GAAP, AU GAAP? No.

- How about a roll forward? Same.

- Adjustment (Originally stated balance +/- any adjustments to arrive at a restated balance)? Same.

- A member aggregation (which is simply a roll up represented using a different technical approach)? Same.

- Variance? Same.

- Is “arithmetic” different in US GAAP, IFRS, UK GAAP, AU GAAP? Of course not.

- Is "logic" used by US GAAP, IFRS, UK GAAP, AU GAAP different? Of course not.

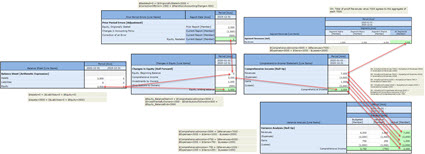

Here is a visual representation of the mathematical interconnections:

Here is the next level of logic, the elements of financial statements of numerous financial reporting schemes.

And so, not only are financial reports knowledge graphs, there is a logical meta-model that describes financial reports generally (see Logical Theory Describing Financial Report). It is this consistent logic that provides the patterns that are used to control processes; the basis for the Seattle Method. This is the magic of the double entry accounting model and the accounting equation. To understand, start by reading the Essence of Accounting. Then, dive into the Essentials of XBRL-based Digital Financial Reporting. Then check out these examples that will help you better learn XBRL-based digital financial reporting.