Yesterday I posted information about a prototype comparison tool I created.

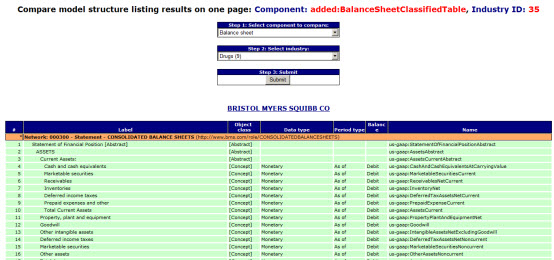

Here is another one. This comparison tool lets you select a financial report component and then an industry group. This limits your comparison to a specific industry.

Pretty straight forward stuff, if one can figure out which components of each company which you want to compare.

Here is why this is someone challenging. In order to compare a component, you need to identify the component you wish to compare. No problem, every SEC 10-K and 10-Q filing has a balance sheet. But, every SEC filer identifies the balance sheet differently. Here is a list of the balance sheet identifiers for this set of 291 SEC filings I am working with: Balance sheets.

All different. Same for the income statement, cash flow statement, document information, significant accounting policies.

So, why is it the case that the SEC or FASB or someone could not say "To identify the balance sheet, use the network identifier 'http://fasb.org/financialReportComponents/BalanceSheet'? Well, they could have. Or, even better in my view, if everyone creating a balance sheet used the table "us-gaap:BalanceSheetTable". That would work also. In fact, that is sort of another problem, what identifies the component, the network or the [Table].

Very, very frustrating for anyone trying to use the information. Now, you CAN figure this out. If you read the section of the Digital Financial Reporting resource related to analysis, which you can get here, and check out the section on prototype theory; you will see that it is still possible to identify things; but it is still harder than it really needs to be if you ask me.

Perhaps there is some reason why every filer creating their own unique identifier for every single component expressed in a financial report is better. If you know the reason why, please let me know.