Over the years I have done a lot of fiddling around with RDF/OWL in trying to grasp how to best make use of XBRL. Just as XBRL is a tool, RDF/OWL is a tool. As is said, "If the only tool you have in your toolbox is a hammer, then everything looks like a nail." Not that having a big tool box and a lot of tools makes one a great craftsman; understanding which tool is the best tool for a particular job does have its advantages.

While I do get the big picture when it comes to RDF/OWL and intuitively I understand RDF/OWL has lots of power which can be leveraged when working with XBRL, I regretfully don't get the details very well yet. But, I do understand a little. More importantly, I am investing to understand more because I grasp why RDF/OWL will be so useful.

The Financial Report Semantics and Dynamics Theory breaks down a financial report into logical pieces. The US GAAP Taxonomy and SEC XBRLfinancial reports are instantiations of "digital financial reports". US GAAP, as defined by the FASB, has semantics. All these things can be tied together semantically using RDF/OWL.

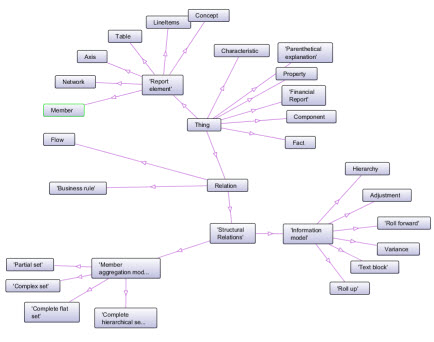

This is a link to where I am currently in hooking all this semantic information together, this ontology for a digital financial report. It is really only the beginnings of an ontology. The XML file can be hard for humans to read, but it is not really meant for humans; it is meant for computers to read. This diagram can help you understand what is in that ontology currently:

If you are interested in understanding what is under the hood here, Stanford University makes a tool available called Protege which can help you visualize RDF/OWL ontologies. The tool is rather technical so most business users won't relate to it very well most likely.

What does all this mean? Well, it means that financial reporting is about to go through a big change. While the XBRL technical syntax enables that change; XBRL is not the change. If you don't understand what terms like "semantics" and "metadata" mean, you are at a disadvantage because you don't understand the moving parts of the puzzle. If you are an accountant obsessed with the financial concept of an SEC XBRL financial report (a form of myopia like the marketing myopia which we all studied in college) you will be out of place when this new paradigm takes hold.

Not quite sure what to do? This is a good place to start: Guide to Verification of an SEC XBRL Financial Report.

It may not seem like the right starting point, but trust me when I tell you that it is exactly the right place to start. Like Stephen Covey says in his book 7 Habits of Highly Effective People,

"Begin with the end in mind."