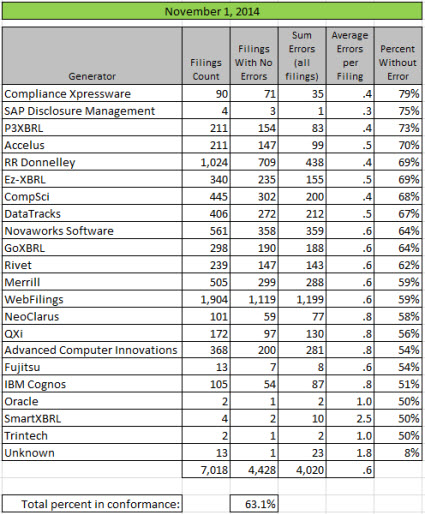

Because it is so easy now and because a fair amount of filings are submitted at the end of October, I re-ran my analysis of fundamental accounting concept conformance. The percentage of public companies who conform to all of these relations is up to 63.1%. This graphic shows breakdown by software vendor/filing agent:

Ask yourself a question: Why exactly would conformance to accounting relations differ by software vendor or filing agent? Think about that.

Not a big percentage change, but not bad either for just about two weeks. The graphic below shows a comparison of analysis results for: March, September, October, and November. (Click the image to get a larger readable view)

My testing tools continue to improve. One of the leaps that I will start making is from using one set of fundamental accounting concept relations that all filers fit into, to multiple hierarchies of relations. I have always known that there is not one set of fundamental accounting concepts, there are many sets. The data shows that about 90% of public companies all into about 10 to maybe 15 groups. I may, or may not, be able to then reconcile all of these groups together into a "super" set of fundamental accounting concepts which allows comparison across groups.

The exact number of groups will become clearer and clear as the public companies are put into groups. These are the primary groups that I have thus far. You can look at this as "industry sectors" or "accounting activities" or "industry audit guides". The point is, there are groups:

- commercial and industrial companies (most public companies, about 85% of all companies)

- interest based revenues (about 610 public companies identified so far such as banks)

- insurance based revenues (about 50 public companies identified so far, insurance companies)

- securities based revenues (about 100 public companies identified so far such as brokers/dealers in securities

- real estate investment trusts (about 130 public companies identified so far, all REITs)

- funds and trusts (about 375 public companies, no interest in these)

Each of these different types of reporting entities, or industry types or types of accounting activities, report in specific ways. From what I am seeing thus far, the most consistent and correct right not is interest based reporting. About 70% of all banks follow one consistent pattern and have complete conformance to that specific/specialized set of fundamental accounting concepts.

I am going to publish these specific/specialized sets of fundamental accounting concepts here with the rest of the information I am publishing on this topic.

One of the most interesting things that this exercise will provide is an "inventory" of the reporting flexibility which is employed by public companies. For example, see this analysis of all the places public companies report income (loss) from equity method investments.

Professional accountants, ask yourself a question. Where you aware that there were so many different places you could put that line item? Personally, I had no idea this level of flexibility existed and pretty much every accountant I have talked to was a little surprised. Was this flexibility an intended, conscious choice by those writing the accounting standards or was it caused by poor attention to detail in writing the standards? I don't know, I am simply asking the question. If you know or have an opinion, leave me a comment.

What if you could see all of this flexibility, organized by industry activity grouping? I think that is a useful tool. What do you think?