Prudence dictates that using financial information in SEC XBRL financial filings should not be a guessing game. Safe, reliable, predictable, automated reuse of reported financial information seems preferable.

So, how is safe, reliable, predictable, automated reuse of reported financial information achieved?

SEC EDGAR Filer Manual (EFM) rules are only the beginning of what is necessary for investors, analysts, and others to use this information. EFM rules are necessary, but they are not sufficient.

For a number of years I have been poking and prodding SEC XBRL financial filings to understand how to construct XBRL taxonomies within systems that allow extensibility. A byproduct of that poking and prodding is an understanding of what causes information contained in SEC XBRL financial filings to be ambiguous, to not be decipherable by automated computer processes, to yield "red flags" which indicate the information may not be trustworthy to automated computer processes; basically what causes reported information to be unusable by automated processes.

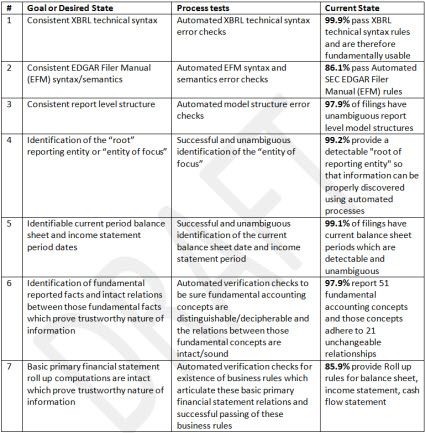

Or stating this another way: there is a set of minimum criteria which are necessary for making use of information contained in SEC XBRL financial filings. This is that set of seven criteria. These criteria state the goal or desired/necessary state, a process which can be used to test that goal, and the current state of SEC XBRL financial filings toward satisfying that goal or desired state:

Click image to view larger version

Click image to view larger version

To be clear, meeting these seven criteria does not mean that all information in an SEC XBRL financial filing would be usable. These seven criteria are necessaryfor safe, reliable, predictable automated reuse of any information at all. But meeting these seven criteria is not sufficient for making use of all information reported in an SEC XBRL financial filing.

An interesting thing about these criteria is the current state of SEC XBRL financial filings in meeting the criteria. Today, SEC XBRL financial filings satisfy between the low of 85.9% for criteria #7 to a high of 99.9% for criteria #1.

And so, this is my set of minimum criteria which I will be using to evaluate the set of 10-K financial filings submitted to the SEC for 2013. My analysis of 7,160 SEC XBRL financial filings for last year helped me arrive at these seven criteria.

Are these criteria fair? I believe they are fair. What do you think? None of these criteria are subjective, all are objective. All are automatable. There has not been one accountant that I have talked to who has articulated specific objection to the criteria.

The proof is in the pudding as is said. No one that I am aware of has shown successful use of basic financial information within SEC XBRL financial filings. And I mean 100% automated reuse without the need for manually adjusting information or writing special algorithms to handle special situations. I mean 100% automated reuse.

And I am not even saying that all my rules are 100% correct. You can see the results that I get, note the current state percentages. Don't think my rules/criteria are correct? I will take any suggestions which result in improved success rates. Again, this is not subjective and this should not be a guessing game. There are exactly three moving pieces here:

- The SEC XBRL financial filings.

- The rules or criteria.

- The software algorithm for making use of information.

The goal is simple: 100% success for each criteria. Change the filing, change the rules, or change the software algorithm. Pretty straight forward. The goal is system equilibrium.

So far there are approximately 1,000 SEC XBRL financial filings, or about 20% of total filings which pass all seven criteria. Most SEC XBRL filers pass the vast majority but they don't pass all. For all those that do not pass, the exact reason they do not pass can be seen in their SEC XBRL financial filing. Whether the filing should be changed, whether the rule/criteria should be changed, or whether the software algorithm should be changed can be somewhat subjective. Let me remind you:

Prudence dictates that using financial information in SEC XBRL financial filings should not be a guessing game. Safe, reliable, predictable, automated reuse of reported financial information seems preferable.

I am going to update all my information shortly after February 28th, the end of the 10-K season for most filers for fiscal year 2013.

If you have objective information which proves or disproves these criteria or if you have a better way of evaluating SEC XBRL financial filings or a more successful way of reusing reported financial information it would be great to hear your comments.