The following is a summary of information about XBRL-based digital financial reports which may, or may not, be apparent to you. All this was not apparent to me until I observed very deeply many, many XBRL-based public company digital financial reports. This information is not laid out well in either the US GAAP XBRL Taxonomy nor in the SEC Edgar Filer Manual.

Notion of "Section" or "Report Fragment" or "Component"

While it does not have an official name in the EFM, section 6.7.12implies the notion of a "section" or what the US GAAP XBRL Taxonomy architecture calls a "report fragment" or what I call a "component":

6.7.12 A link:roleType element must contain a link:definition child element whose content will communicate the title of the section, the level of facts in the instance that a presentation relationship in the base set of that role would display, and sort alphanumerically into the order that sections appear in the official HTML/ASCII document.

The link:roleType link:definition text must match the following pattern:

{SortCode} - {Type} - {Title}

The {Type} must be one of the words ‘Disclosure’, ‘Document’, ‘Schedule’ or ‘Statement’.

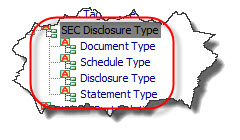

I gave this idea a name, the "SEC Disclosure Type", and represented this information in the Financial Report Ontology:

Notion of "Level"

Later on in that same section 6.7.12, the EFM discusses the notion of "level" and explains the ordering of the sections (described above) relative to one another. That section states, in part:

1. Each Statement must appear in at least one base set, in the order the statement appeared in the official HTML/ASCII document.

2. If the presentation relationships of more than one base set contains the facts of a Statement(to achieve a layout effect, such as a set of rows, followed by a table with a dimension axis on the vertical, followed by another set of rows) then the {SortCode} of that base set must sort in the order that the rows of the Statement will be displayed.

3. A Statement that contains parenthetical disclosures on one or more rows must have a base set immediately following that of the Statement, where all facts in its parenthetical disclosures appear in presentation relationships.

4. All base sets containing the contents of Footnotes must appear after base sets containing the contents of Statements.

5. A Text Block for each Footnote must appear in at least one presentation relationship in a base set.

6. Each base set for a “Footnote as a Text Block” presentation link must contain one presentation relationship whose target is a Text Block.

7. Base sets with presentation relationships for a Footnote tagged at level 2 must appear after all base sets tagged at level 1.

8. A base set with presentation relationships for a Footnote tagged at level 3 must appear after all base sets tagged at level 2.

9. A base set with presentation relationships for a Footnote tagged at level 4 must appear after all base sets tagged at level 3.

A couple of things. The EFM the term "base set" when they actually mean "Network" or "Network of relations" I believe. Regardless, what they are referring to is the sections or fragments or components that make up a full report which are represented by the "base set" or "Network" or "Network of relations".

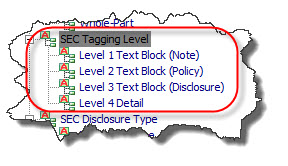

I captured the notion of "level" in the Financial Report Ontology as follows:

Notion of Report Element Categories

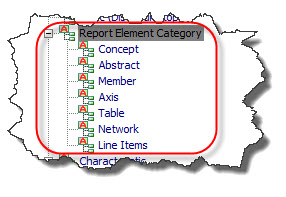

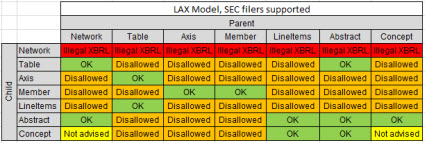

Both the EFM and the US GAAP XBRL Taxonomy Architecture imply the notion of report element categories.

Further, there are allowed and disallowed relations between these report element categories which I have summarized graphically as follows:

(Click image for larger view and more information)

(Click image for larger view and more information)

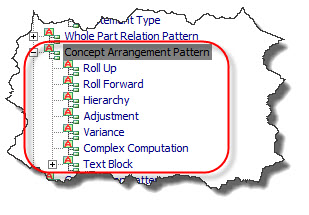

Notion of the Concept Arrangement Pattern

Concepts (and Abstracts which is a form of a concept) are arranged in patterns. The US GAAP XBRL Taxonomy explicitly mentions the "Roll Forward" pattern (Beginning balance + Changes = Ending Balance). But there are other patterns. These are summarized in the Financial Report Ontology as follows:

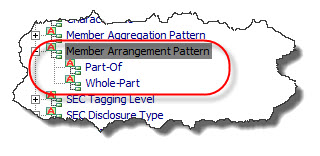

Notion of the Member Arrangement Pattern

Just like how concepts have arrangement patterns; the [Member]s within an [Axis] likewise have patterns. While not as fully developed (yet), there are two specific types of patterns which are articulated in the Financial Report Ontology:

A "Whole-Part" relation is where something is composed exactly of their parts and nothing else or more where the parts add up to the whole. A "Part-Of" relation simply describes the parts, but the parts do not add up.

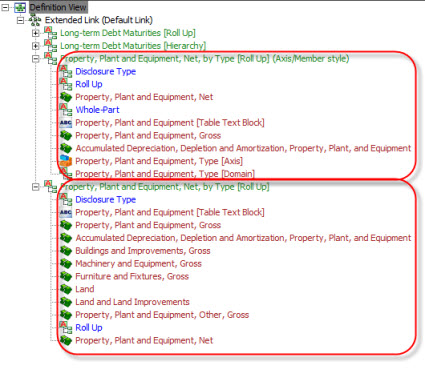

Relation Between Level 3 Text Block and Level 4 Detailed Disclosure

If you read the EFM or observe XBRL-based public company financial filings, you understand that there is a relationship between the Level 3 Text Block disclosure and the Level 4 Detailed disclosure of information. Here are two specific comparisons:

If you look at those two documents and you consider the other information above (and other information which I have not gone over), you see lots of patterns. To provide a basic example, consider those two disclosures above. These can be found represented in XBRL-based public company financial filings in at least the following four ways:

- Property, plant, and equipment by Type [Roll Up]

- Property, plant, and equipment by Type [Roll Up] (using Axis/Member)

- Long-term debt maturities [Roll Up]

- Long-term debt maturities [Hierarchy]

Notion of Disclosure Business Rules

You take all the information above and you can articulate knowledge in machine-readable form. Here is an example of four such disclosure business rules:

Those machine-readable rules (which you can grab here) can be used to generate the human-readable business rules needed by business professionals.

Business rules for every disclosure

Similar to the fundamental accounting concept relations business rules, imagine business rules for every possible disclosure. That is what is on deck for XBRL-based public company financial reports! Just like the fundamental accounting concept relations consistency can be measured, consistency of disclosures to the disclosure rules can likewise be measured.

A financial report is really many report fragments which work together to represent the entire report. The report fragments need to be internally consistent and consistent with other reoprt fragments. Why is this important? These rules are used to both describe and keep digital financial reports consistent with that description.

For more information, please read chapters 1 through 10 of Digital Financial Reporting.