There are two interesting phenomenon related to XBRL-based public company financial filings submitted to the SEC. Here is a summary of the two phenomenon which I will explain in further detail and show examples of below and what the phenomenon means as I see it:

- XBRL-based filings can go from correct, to incorrect, and then back to correct from period to period per some unknown random pattern.

- Basic, fundamental accounting concept relations appears to be dependent on the creation software used to create a financial report.

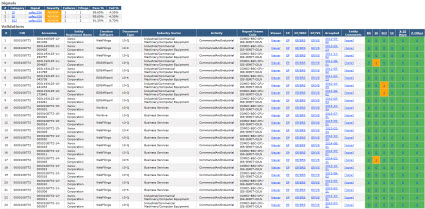

So let us dig into these phenomenon. To start off, click on the image below which shows a summary of all the XBRL-based financial filings submitted to the SEC by Microsoft and a summary of the consistency of each financial report to a set of basic, fundamental accounting concept relations.

As you look at that summary, first be aware that this summary and all of the other summaries are not in order by date. So, you need to look at the column "Accepted" and consider the date to see the precise ordering of the submitted reports.

The order does not really matter for what I want to point out about the Microsoft filings. Notice how the vast, vast majority of the columns are GREEN and you have a few cells that are ORANGE. The GREEN indicates consistency with the set of fundamental accounting concept relations and the ORANGE indicates inconsistencies exist. The exact same fundamental accounting concept relations consistency checks were applied to all the filings.

So ask yourself a question: Why would the XBRL-based financial report of Microsoft be consistent in one period but NOT be consistent in the two periods in that list where their the color ORANGE indicates and inconsistency?

Well, the answer to the question is: Errors creep into the filing. Someone perhaps changed a concept they should not have changed or entered a number incorrectly. But the bottom line is that some sort of inconsistency was induced.

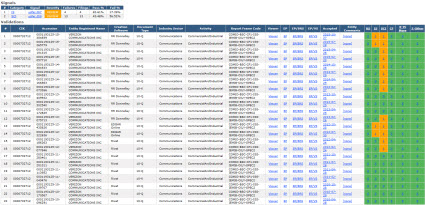

Errors creeping into filings is not unique to Microsoft. Here is another filer, Xerox:

Pretty much the same story as Microsoft except that they have a few more inconsistencies in their set of 23 filings to the SEC. But there is one additional difference. Go back and look at Microsoft and notice that the creation software lists "Edgar Online" and "RR Donnelley". RR Donnelley purchased Edgar Online, so the creator is the same really. But now have another look at Xerox and notice they did change the creation software they were using. (Also note that WebFilings changed their name to Workiva, so that really is not a change in creation software.)

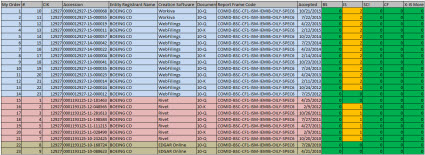

OK, so now look at this set of XBRL-based financial filings submitted to the SEC by Boeing. Again, please take note that the DATES of the submission are NOT IN THE CORRECT ORDER! I will walk you through the list below.

Boeing submitted their first two filings using EDGAR Online and those filings (#9, #8) were 100% consistent with a set of fundamental accounting concept relations. They switched to Rivet and one inconsistency was introduced (#7). That same one inconsistency existed for the next five filing periods (#6 through #2), and then the inconsistency was corrected (#1) and the Boeing XBRL-based financial filing again had no inconsistencies. Then, Boeing switched to WebFilings/Workiva which consistent with the last Rivet created filing was 100% consistent with the same set of fundamental accounting concept relations (#23). But then one inconsistency was introduced (#22) and then two inconsistencies were introduced and persisted (#21 through #10).

To help you see this better, I took the report above and reorganized it by the Accepted date. I also colorized the report by creation software used:

So basically, inconsistencies appear and disappear and there seems to be some correlation between the creation software used and the inconsistencies detected. The Boeing report started out correct, Rivet introduced one inconsistency. Rivet ultimately fixed that inconsistency. WebFiling/Workiva submitted the report with no inconsistencies after the handoff from Rivet. Then Boeing introduced one inconsistency and then a second inconsistency, and that is where they stand as of today.

(FOOTNOTE: Boeing filed their 2015 10-K on February 10, 2016 and corrected one of the two inconsistencies in their financial filing. Also, I got XBRL CLoud to adjsut their report and now it sorts things better. See the updated comparison of Boeing's filings here.)

This phenomenon is not unique to Boeing. Lots of filers have this pattern. Here is Verizon:

I did not point out the periods or creation software, you can figure that out for Verizon.

And there are plenty of other examples of this phenomenon.

Clearly, which creation software is being used should have no impact what-so-ever of the accounting concepts selected and used within a financial report. Clearly, it should not be the case that different creation software products use different sets of rules for verifying the correctness of the reports. Clearly, consistency checks are not a one-time thing and rather need to be performed each time an XBRL-based financial report is submitted to the SEC.

Well, at least that is my view. What do you think?

If you look through the screen shots above you will also notice that the industry sector changes (driven by the SIC code used) and that even the company name used changes.