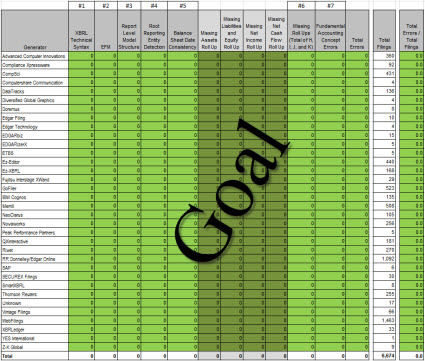

The document Arriving at Digital Financial Reporting All Stars: Summary Information provides information obtained from a detailed analysis of 6674 SEC XBRL financial filings. The purpose was to determine what it takes to actually be able to make use of reported financial information.

While not a scientific experiment or perhaps not perfect in any regard; this exercise was very useful and yielded pragmatic insight into creating and consuming digital financial reports and other types of digital business reports. This information is useful to professional accountants wishing to position themselves well for the future of financial reporting. It is useful to software vendors who might choose to build software to support digital financial reporting. It is useful to regulators who might be considering implementing systems which leverage XBRL-based digital financial reporting for compliance purposes. In is useful to other organizations who might want to experiment with XBRL-based digital business reporting within their organization.

The following is a summary of specific conclusions I have reached and other key insights I have obtained which I believe might also be useful to others. Details can be obtained from the above PDF.

- Currently 19% of all SEC XBRL financial filings analyzed satisfy minimum criteria and 95% are 5 or fewer errors from meeting criteria

- Specific identifiable and observable reasons exist for every issue pointed out

- Using SEC XBRL financial information need not and should not be a guessing game

- Minimum criteria are not judgmental or subjective in nature

- Validation and verification of the seven criteria are 100% automatable

- Current generation of digital financial report creation software has systemic issues

- Need for a framework for tuning the quality of SEC XBRL financial filings

- Need for a roadmap for tuning the quality of SEC XBRL financial filings

- My next level of criteria

- Any system which desires to implement XBRL-based digital financial reporting or XBRL-based digital business reporting can learn from SEC XBRL financial filings

The last point is the primary, key point. If someone wants to make XBRL-based digital financial reporting or XBRL-based digital business reporting work within their systems, SEC XBRL financial filings provide plenty of clues to help figure that out.

I have this vision. It is a simple vision. It is an achievable vision. It is a useful vision. Here is the vision:

Click for larger view of image

Click for larger view of image

Imagine that every software vendor passed 100% of the seven minimum criteria which I outlined in this analysis. What would that mean? It would mean that fundamentally usable information would be provided by all those SEC XBRL financial filings. Yes, it would mean that.

But it would mean much more. What it would mean is that the concept of digital financial report would have been proven to work. What it would mean is that a digital financial reporting beachhead would have been established. What it would mean is that a framework for improving the quality of these digital financial reports even more would have been identified.

I will not go quite as far as saying that for the first time an open system has successfully been implemented, but it is a step in that direction. More on that later.

What it would mean is that about 34 different software vendors have provided off-the-shelf software which was used by 6,674 different public companies to report information to a government regulator and that information can safely, reliably, predictably be used via 100% automated processes to provide reported financial information to countless analysts and investors. This is a meaningful exchange of information.

Tell me that is not useful.

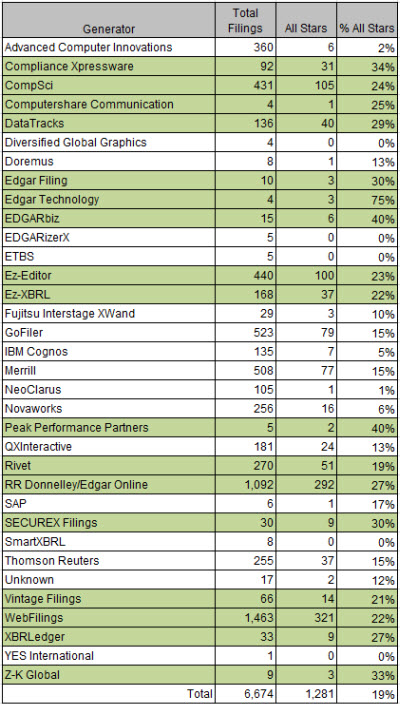

But we are not quite there. The analysis shows that 19% of SEC XBRL financial filings meet this vision, 1281 All-Stars as I call them. But even more encouraging is that 95% of all SEC XBRL financial filings are 5 or fewer errors from achieving this goal. So the vision is already within grasp and what is necessary to achieve that vision is clear.

This is where we currently are in terms of all stars by generator (software vendor or filing agent): (average is 19%; green is at average or above average)

You can interpret this information however you want. This is how I interpret the information. If a software vendor or filing agent does not have 100% all stars, then there is some sort of systemic problem with the software. Full stop. Now you can play the blame game all you want, try and pass the buck. That helps nothing. Solving the problem helps. Achieving the vision helps.

If a software vendor does not understand this or believe this, then they certainly don't understand the bigger opportunity. This is only the tip of a much larger iceberg. Smart digital financial reporting tools are the future. If software cannot control these extremely basic things, there is no way that software can provide smart digital financial reporting functionality. If software does not pass the hurtle of these seven basic criteria, there is little hope that the software will ever be helpful to a professional accountant.

Achieving the vision helps the SEC be successful, it helps the FASB be successful, it helps XBRL US be successful, it helps public companies who are mandated to use XBRL be successful, but most importantly it helps software vendors be successful. The software vendor would have created something that works and is beginning to show signs of usefulness. It will also help the software vendor understand what professional accountants really need.

If software vendors pull this off, achieve the vision above, create something that really works; the software vendors might be able to expand the market: some 8 million private companies, 360,000 not-for-profits, 90,000 state and local governmental entities, and that is just financial reporting in the US. This is not about "save as XBRL". This is about machines assisting professional accountants in the creation of a financial report which is an extremely complex task. In digital financial reporting the output can still be a paper-based financial statement.

If software vendors don't achieve this vision, the market will certainly not expand, it might even contract. Case in point: the legislation to eliminate the XBRL filing requirement for smaller reporting entities, market reduction of 60% by some accounts.

Now, it would be best if all software vendors and filing agents worked to achieve this vision. Some will, some won't. The enemy is not each other, the enemy is the status quo. What if only one achieves 100% all-stars? What will the market do? What will likely happen is that some will achieve this goal, some won't.

I have provided this information to every software vendor and filing agent contact that I have. I have provided the information to the FASB, the SEC, XBRL US, and many others. New software vendors are also entering the market who want to fundamentally change accounting work practices. Be interesting to watch what happens. Be interesting to see who grasps this opportunity.

Am I nuts? Maybe. But that is what I see. What is your view?