Every craftsman values good tools. While a trained craftsman can use any tool and likely still do a better job than an unskilled or under-skilled person performing the same task; craftsmen still value good tools.

Also, a good tool can turn an under-skilled person into a more highly-skilled person if the tool reduces ignorance (i.e. provides increased knowledge).

What can be a problem is if a lesser-skilled person is unaware of things they should be concerned with but the tools they use don't help them to overcome this deficiency in skill or experience.

Accounting professionals working with digital financial reports such as XBRL-based financial filings to the SEC suffer from a lack of quality tools. The good thing is, that is changing.

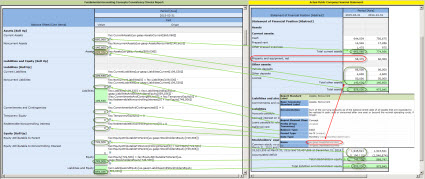

I figure that I am 100 times more productive today than I was only one year ago. This is no exaggeration. Click on the image below and look at the interface that I created for reviewing public company XBRL-based financial reports:

The inconsistency is not visible at all in the actual filing, everything foots correctly and everything else looks just fine. But if you notice the review tool on the left that shows the YELLOW cell, you immediately understand that something is up. If you look closely, you notice that this filer used the concept "us-gaap:AssetsNoncurrent" incorrectly. That concept includes property, plant, and equipment per the US GAAP XBRL taxonomy but if you look at the assets section of the financial report, you see that PPE is not included in the total used to express the fact they are reporting.

So, there are two errors here really. The first error is that the concept the reporting entity is looking for does not exist in the US GAAP XBRL Taxonomy. It needs to be added, that is the first issue. The second is that rather than creating an extension concept, the filer picked some concept that to them seemed close. This conveys the wrong information.

Those are the sorts of issues the fundamental accounting concepts and relations makes very easy to see. Two very, very positive things are happening. First, tools are improving. Second, lots of accountants have experience with using XBRL now after five plus years of creating digital financial reports.

But unfortunately, these sorts of nuances can be hard to recognize with less than optimal tools. So accountants, pester your software vendors for better functionallity.

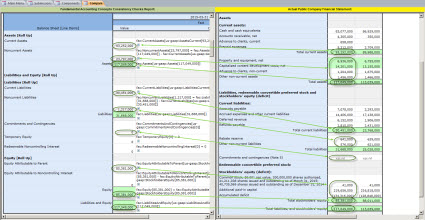

Here is another screen shot, this time with a digital financial report which is consistent with expectation:

(Click image for a larger view)

(Click image for a larger view)

This tool I built myself using Microsoft Access fiddling around with pieces of functionality provided by XBRL Cloud. The tool provides a side-by-side comparison of a financial report with a validation report used to check the consistenty of the financial report. It make it easy to figure out why there is some sort of inconsistency. If you want to know more about this, send me an email and I can provide additional information.