A identification key or taxonomic key is a printed or computer-aided device used for identifying some entity that is unknown. Keys are constructed so that the user is presented with a series of choices about the characteristics of the unknown thing; by making the correct choice at each step of the key, the user is ultimately led to the identity of a thing. Taxonomic keys are also helpful in classifying things into a standard taxonomy consistently.

Here are two examples of printed keys: Example 1 | Example 2

Two examples of machine-readable keys are: Fundament Accounting Concepts and Reporting Styles (Reporting Frame Codes) and Disclosures (Which is a work in progress). Don't be confused by the human-readable stuff that you see. Trust me, all that information is machine-readable in global standard XBRL.

There are two types of keys:

- Single-access keys: A single-access key (dichotomous key, sequential key, analytical key, or pathway key) is an identification key where the sequence and structure of identification steps is fixed by the author of the key.

- Multi-access keys: A multi-access key enables the user to freely choose the set and characteristics that are convenient to evaluate for the item to be identified.

Single-access keys and multi-access keys serve the same purpose. Each approach has its advantages and disadvantages.

One advantage of multi-access keys is that users can enter or select information about an unidentified thing in any order, allowing the computer to interactively rule out possible identifications of the entity and present the user with additional helpful information and guidance on what information to enter next. A disavantage of multi-access keys is that you have to understand a certain amount about a domain to use them; the more you understand about a domain the more useful multi-access keys can be.

One advantage of single-access keys is that if you don't understand the domain or don't understand enough the single-access keys can serve as bread crumbs that provide a path to the answer you are looking for.

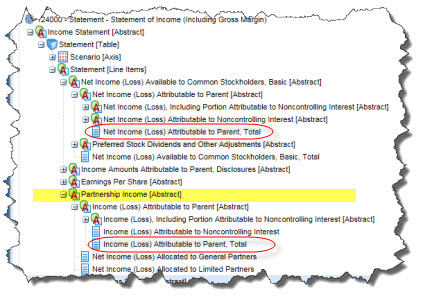

How do taxonomic keys relate to financial reporting? Here is a specific example. When you are trying to find a concept in a taxonomy "hunt-and-peck" will work. You can also consult with an expensive expert. Another approach is to leverage a taxonomic key. The US GAAP Financial Reporting XBRL Taxonomy provides the following two concepts:

- Net Income (Loss) Attributable to Parent (us-gaap:NetIncomeLoss) which has the documentation "The portion of profit or loss for the period, net of income taxes, which is attributable to the parent."

- Income (Loss) Attributable to Parent (us-gaap:IncomeLossAttributableToParent) which has the documentation "The portion of profit or loss for the period which is attributable to the parent."

The only difference in the documentation is that the first has "net of income taxes" and the second does not. Does that mean that the first is used if you have income taxes and the second is not? No. There are a lot of public companies don't report income taxes and use the first concept.

The difference between the two concepts is that the first applies to corporations and the second applies to partnerships. How do I know that? Two reasons. First, if you look at the hierarchy of concepts in the presentation relations, the second is contained within the parent concept which is "Partnership income".

Another reason I know this is that the majority of corporations use the first concept wether they report taxes or not.

So, if you were working with the US GAAP Financial Reporting XBRL Taxonomy and the software tool you were using knew that the financial report was a corporation and not a partnership, it could help guide you to the correct concepts within the taxonomy. The same idea applies to what type of industry or accounting activities you report, what style of reporting you use, preferences you have, and so on. Software can help guide you through the process of using the taxonomy more correctly by understanding things about the taxonomy concepts that you might use.

There are other uses for keys. "Hunt-and-peck" and "consult an expert" works for creating disclosures also. But computer-aided taxonomic keys work well also. If you think about what I pointed out in the blog post Automating Accounting and Reporting Checklists, keys is one of the technology tools that can be leveraged by computers to help professional accountants perform work. The more metadata you have, the more keys you can provide.