Audit, reporting, accounting, and analysis all have their issues and can be improved.

Technologies such as structured machine-readable information (such as XBRL), digital distributed ledgers, knowledge based systems, and artificial intelligence offers an unprecedented opportunity to create what I am calling Computational Professional Services.

Some people call this "smart regulation". Others call it "algorithmic regulation". Still others us the term "rules as code". Some use the term "robo cop". Deloitte seems to use the term "finance factory". The SEC has a vision. "Continuous audit" and "continuous reporting" fit into computational professional services. Another term for all this is "finance transformation".

But, whatever you call it; many of the repetitive, monotonous, routine, mechanical, boring tasks and processes related to accounting, reporting, auditing, and analysis be performed by machines which will free up humans to do more interesting work. This transformation is about talent, not technology. (This begs the question as to whether accountants should learn to code)

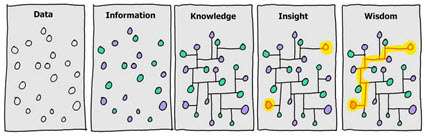

Professional services is about rearranging abstract symbols that represent information and knowledge. Computers can help perform these tasks and processes much like a calculator helps accountants do math.

So how do you get computational professional services to work effectively? Well, XBRL-based digital financial reporting to the SEC and ESMA offers a bunch of clues if you know where to look. Check out the document on that first link.

Here is how you implement computational professional services.

###########################