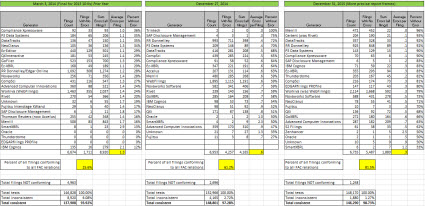

This graphic shows public company XBRL-based digital financial report submitted to the SEC quality as measured by a set of basic, common sense fundamental accounting concept relations. These measurements were taken March 1, 2014; December 27, 2014; and December 31, 2015:

There are three possible reasons for an inconsistency with one of the basic, common sense fundamental accounting concept relations:

- Filer error

- US GAAP XBRL Taxonomy error

- Test metadata error

During that period of time I have learned a great deal and made some adjustments which improved the process of using automated machine-based processes to check the consistency of public company XBRL-based digital financial reports.

- I started with one single set of these basic fundamental accounting concept relations. But this set was too general. For example, different relations apply to banks which use interest-based reporting and commercial industrial companies.

- I took the single set, added the notion of what I called "report frames", and came up with a more flexible approach to articulate and manage these basic, common sense fundamental accounting concept relations. But I made these report frames to general in many cases.

- I fiddled around with reporting frames more and realized that a better term than "reporting frame" or "reporting palette" was simply "reporting style".

- I embraced the notion of reporting style. I was able to document all of these reporting styles and learned more and more about the different reporting styles used.

- I realized that looking at the reporting style of each report was not the way to look at this, rather it was better to look at the specific parts of the report: style of the balance sheet, style of the income statement, style of the statement of comprehensive income, cash flow statement.

- Finally, I realized that I don't want to create a few general reporting styles. Rather, what I need is precise and specific reporting styles because of the ways public companies report. More precise reporting styles make everything work better plus maintenance of the machine-readable rules is easier.

And so, during the month of December I converted literally hundreds of public companies from less precise general report frames to more precise specific report styles. One of the side benefits of the more precise report styles is that extracting information is also safe and reliable. Currently,

- 91.4% of all filers (that is 6,158 of public companies) fit into one of these more precise report styles

- 8.6% of all filers (that is 577 public companies) have unique reporting styles or fit into a reporting style which I have not yet created.

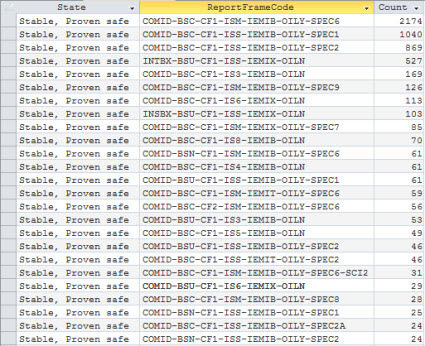

What is even more interesting is that 88% of public companies fit into one of only 25 different reporting styles which are summarized below:

The remaining public companies fit into one of 58 reporting styles. There are a total of 109 reporting styles. This metadata is not updated yet, but I will update it. All this is implemented, tested, and working. XBRL Cloud uses this metadata in their fundamental accounting concept relation validation processes. Not sure when all this will be available publically.

There is one final issue that I think I have resolved, but I am not completely sure because I have not tested it comprehensibly enough. I have another similar but slightly different approach to representing machine-readable business rules for disclosures. The fundamental accounting concept relations do not use this approach completely. The impute rules for the fundamental accounting concepts are not expressed using the XBRL technical syntax. They are expressed using a proprietary approach because I did not think I could express this information using XBRL Formula and I though that an XBRL Formula processor was not capable of processing the impute rules. Well, both of those assumptions were incorrect. There is a way to represent those impute rules using XBRL Formula, I am 100% sure of that. And although the processing of the rules is not "standard" (because XBRL Formula does not have a global standard chaining specification); you can process one rule at a time (which is standard) and then you can chain the entire process together however you see fit (which is not standard, but it will work).

And so, that is the direction I am going along with a handful of other software vendors who get all this stuff already. The reason this is important is because there are thousands and thousands of business rules related to disclosures. Not implementing these correctly will cause scalability issues, maintenance issues, and will cause software vendors to have to reinvent things that have already been invented and are proven to work.

* * *

Previous fundamental accounting concept relations consistency results reported: November 30, 2015; October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.