Harvard Business School: The Landscape of Integrated Reporting

Harvard Business School held a workshop, A Workshop on Integrated Reporting: Frameworks and Action Plan. As part of that workshop an eBook, The Landscape of Integrated Reporting, Reflections and Next Steps, was made available.

The executive summary of the workshop provides the following conference overview:

Business has lost society’s trust and must act to restore it. One way to do so is through ideas and processes that demonstrate that business cares about more than just profit. Integrated reporting is a way to show society that business cares, is holding itself accountable, and is measuring itself on matters that society cares about.

While perhaps a bit ahead of the curve, the timing is right to be holding this conversation and the topic is of great importance. Harvard Business School is committed to this subject, which is reflected in HBS’s own reporting efforts and by supporting this workshop.

The book is a collection of papers submitted to the conference and provides a summary of the current thinking on integrated reporting. The book is packed with information, about 334.

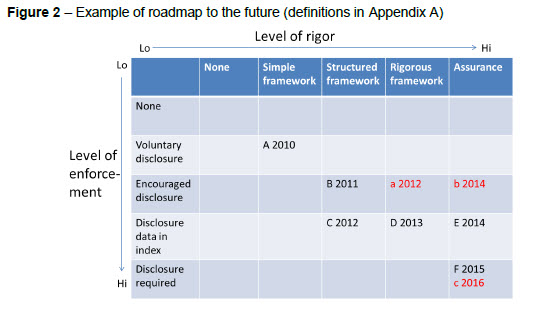

One of the interesting things in the ebook is this graphic (from page 324) which provides an example road map to the future. The graphic shows an evolution of the framework. The reason the graphic is interesting to me as it explains the process we are going through with SEC XBRL filings.

I like the way it shows an evolution from nothing, to a simple framework, to a structured framework, to a more rigorous framework, and then throwing in assurance.

In my view, that is similar to what is going on with SEC XBRL filings right now. We went from no XBRL filings, to a simple US GAAP taxonomy and a simple filing framework and XBRL instances. We learned from that. I think we are still in that simple framework level currently.

Over the coming years we will evolve to a more structured and rigorous US GAAP Taxonomy and SEC XBRL filings. A lot has been learned in the past couple of years; this will contribute to a more structured an rigorous, and therefore more useful, set of SEC XBRL filings.

Reader Comments