This blog is basically my lab notebook relating to the creation of what I am now referring to as the Seattle Method of XBRL-based digital financial reporting. This blog relates to figuring out how to effectively leverage XBRL formatted structured information for accounting, reporting, auditing, and analysis in a digital environment. If you want to understand this information, then START HERE!!!

Going forward, this is my NEW BLOG.

Read more about the biggest change in accounting in 500 years, The Great Transmutation. The document Evolution of a System provides a framework for understanding how the changes will unfold.

Theory, Framework, Method, Principles

What is conspicuously lacking in most people's mind is a broad framework let alone a theory on how to think about digital financial reports. We provide that framework and theory. Also, we distill accounting and reporting down to its essence and help you understand knowledge graphs:

- Theory: Logical Theory Describing Financial Report

- Framework: Standard Business Report Model (SBRM)

- Method: Understanding Method (Abridged); Seattle Method

- Principles: XBRL-based Financial Reporting Principles

- XBRL: Essentials of XBRL-based Digital Financial Reporting

- Accounting and reporting: Essence of Accounting

- General purpose financial report: Essence of Financial Reporting

- Financial report: Financial Report Knowledge Graphs

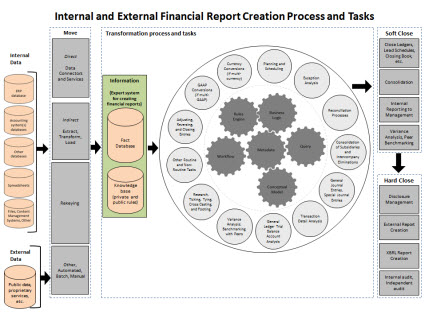

- Record to report: Effective Automation of Record to Report; Business Events

- Mastering: Mastering XBRL-based Digital Financial Reporting

- Expert system: Expert System for Creating Financial Reports Explained in Simple Terms

- Logical Schema: Logical Schema of Financial Reports

- Knowledge Portal: Prototype; Vision

- PROOF: PROOF

- Examples: Platinum Use Cases and Test Cases

Financial Reporting Schemes (working prototypes)

Human-readable and machine-readable knowledge graphs of financial reporting schemes implemented using the good practices method (described in prior section). This machine readable metadata can be used to supercharge rules-based artificial intelligence software applications for creating financial reports. Below are progressively more and more complicated/sophistocated examples of financial reporting schemes:

- Accounting Equation: Extremely basic financial reporting scheme used for training. COMPLETE. Tested.

- SFAC 6 Elements of Financial Statements: Extremely basic financial reporting scheme used for training. COMPLETE. Tested.

- SFAC 8: Another version similar to SFAC 6, but includes Net Assets and Fund Balance.

- Common Elements of Financial Statements: Extremely basic financial reporting scheme used for training, the four statement model; starting to look like a financial statement. COMPLETE. Tested.

- Common2: Another version of the above. Complete, tested.

- Common3: Another even better version of the above. Complete, tested.

- PROOF: The PROOF is a baseline small but very sophistocated working proof of concept that is a synthasis of all the functionality of the other financial reporting schemes into a small package that can be used for testing and training. COMPLETE. Tested.

- MINI: The MINI financial reporting scheme focuses on the flow of accounting information and is used to better understand how taxonomies work and how to implement XBRL within the enterprise for internal reporting. COMPLETE. Tested.

- MINI Including Business Events: Another version of the MINI financial reporting scheme that includes business events and classic transactions. COMPLETE. Tested.

- XASB: The XASB financial reporting scheme has all the characteristics that you would find in US GAAP or IFRS but with only a fraction of the volume of taxonomy report elements. COMPLETE. Tested.

- AASB 1060: The AASB 1060 is a real financial reporting scheme for small and medium sized entities that is about 20% complete. But that 20% set is FULLY COMPLETE and demonstrates what a base financial reporting scheme should look like. COMPLETE. Tested.

- AASB 1060 Alternative Interface: Same as above, but a different style of interface to interact with the financial reporting scheme. (Prototype)

- Primary Financial Statements for IFRS (Prototype)

- Essence: Example of fundamental accounting concepts. (Prototype)

- Not for Profit (NFP): The NFP financial reporting scheme is provided to again show that this method can handle diversity in reporting schemes. Also excellent for testing. (INCOMPLETE, not rigorously tested)

- IPSAS: The International Public Sector Accounting Standards (IPSAS) financial reporting scheme representation helps show diversity for the method to handle any financial reporting scheme and get people thinking about creating this important XBRL taxonomy. INCOMPLETE. Not rigorously tested.

- IFRS: The International Financial Reporting Standards (IFRS) reporting scheme supplements the commercial IFRS XBRL taxonomy provided by the IFRS Foundation, supplementing that XBRL taxonomy with missing information. INCOMPLETE.

- US GAAP: The United States Generally Accepted Accounting Principles (US GAAP) financial reporting knowledge graph supplements the US GAAP XBRL Taxonomy provided by the FASB for public company financial reporting to the SEC; supplementing it with missing information. INCOMPLETE.

By COMPLETE and INCOMPLETE I mean that it is possible to construct a complete working financial report system using that knowledge graph and then also prove that the system is properly functioning with the rules and metadata provided. The last two taxonomies, IFRS and US GAAP, have perhaps several thousand disclosures that must be provided for. In this way, IFRS and US GAAP are incomplete. The other seven taxonomies are intended to help on understand the difference between complete and incomplete.

Understanding Basics of XBRL-based Financial Reporting:

- Computational Professional Services: This helps you get your head around what literally could be the biggest change in accounting in 500 years!

- Gentle and Cheap Introduction to XBRL-based Financial Reporting: Good place to start.

- Basics: Build on the gentle introduction.

- Essentials of XBRL-based Digital Financial Reporting: Establishing a solid foundation.

- Proof baseline: Puts all of the pieces of the puzzle together to help you get your head around XBRL-based digital financial reporting.

- Corporate Financial Reporting Class: Provides information used to understand XBRL-based corporate financial reporting.

- Proof Comparison: Mechanism for solidifying your understanding of semantics.

- Effective Automation of Record to Report Process: Helps you understand how to implement modern approaches to accounting, reporting, audit, and analysis.

- Framework and Method: This is my complete framework and method summarized in one place with links to all the details.

- Essence of Accounting: Explains the dynamics of accounting, very helpful to computer science professionals, software developers, and knowlege engineers (and accountants).

Mastering XBRL-based Digital Financial Reporting Prototypes: Believe that XBRL-based digital financial reporting will play a significant role in the future of financial reporting? Go here for information that will help you master XBRL-based digital financial reporting. (Most current protypes)

Trying to get your head around XBRL-based digital financial reporting? Download Pesseract and experience it first hand. Pesseract is, I believe, the world's first expert system for creating financial reports using any financial reporting scheme.

* * *

For a list of all blog posts, click here. For resources to learn about XBRL, click here. Examples, samples, and metadata on GitHub, click here. Watch the popular video, How XBRL Works. To get the background to understand the changes that are occuring, read Computer Empathy. If you want to get everything in on place, see Intelligent XBRL-based Digital Financial Reporting.

"If you have an apple and I have an apple and we exchange apples then you and I will still each have one apple. But if you have an idea and I have an idea and we exchange these ideas, then each of us will have two ideas."

Digital financial reporting is the future of financial reporting. Just like blueprints went digital, maps went digital, and many other things have gone digital; so to are financial reports are going digital. A recent AICPA News Update stated the following:

Technology has undoubtedly been the catalyst for change throughout history. But today, this change is happening faster than ever before. The world will look very different in a few years - and the accounting profession is no exception. Artificial intelligence, blockchain and other technologies are poised to reshape the accounting landscape, and we need to be ready.

What traditional core tasks will be automated? What will be the new "form" the profession will take?

"Where there is no order there is confusion." Luca Pacioli

This site will evolve. If you want to provide feedback or have questions or comments, please contact: Charles.Hoffman@me.com.

Feedback and comments welcomed.

Resources:

- XBRL Cloud Edgar Dashboard

- Amana Dashboard of ESEF Reports

- XBRL International Dashboard of ESEF Reports

- My Dashboard of DOW 30 Companies

- Prototype Dashboard of XBRL-based Reports Using Seattle Method