Building your Understanding of an [Axis], Characteristics of a Fact

In a previous blog postI explained that an [Axis] is "a means of providing information about the characteristics of a fact reported within a business report." Looking at a very simple area of an SEC XBRL financial filing helps to better understand how [Axis] work.

For a complete set of the SEC XBRL filings examined for this analysis, grab this Excel spreadsheet or this PDF. You can follow along using this PDF which walks you through the various scenarios discussed. It is hard to make each of these images fit in the narrow blog page.

So, let us consider the document and entity information of an SEC XBRL filing which is relatively consistent.

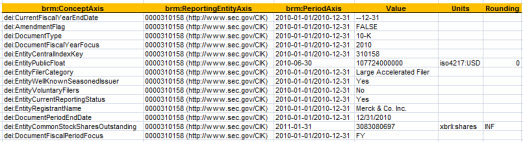

Scenario A: Basic document information: Here you see the basic [Axis] used by many filers when reporting document and entity information.

All of the other scenarios build on this base case scenario where a filer is reporting document and entity information. Again, visual images are provided in this PDF which are helpful in understanding the different scenarios.

Scenario B: Legal Entity [Axis] is Explicit: This filer explicitly adds the axis "dei:LegalEntityAxis" to the document and entity information [Table] (as compared to the scenario above where the filer did not even create a [Table], using only the concept, reporting entity, and period [Axis]). This raises the question, why are these two SEC XBRL filings using different [Axis] on what amounts to basically the same information?

Edgar Filer Manual Section: The EFM states in essence that if you do not explicitly provide a "dei:LegalEntityAxis" it is assumed or implied that all information reported relates to the "consolidated entity" (which is represented in the US GAAP taxonomy by the member "dei:EntityDomain". Personally I believe that being explicit is better, particularly now with XBRL viewer and analysis software not being very mature. Further, generic off-the-shelf XBRL software does not understand what the SEC is or is not implying.

Scenario C: Legal Entity [Axis] is Implied: So in essence, even if the an SEC filer does not explicitly provide the dei:LegalEntityAxis with the value of dei:EntityDomain, which represents to consolidated entity; it can be implied that the information relates to the consolidated entity. This scenario repeats scenario A, just showing that the legal entity, although it is not physically there, semantically it actualy does exist.

Scenario D: Legal Entity [Axis] is Explicit, Class of Stock [Axis] Explicit: This SEC filer makes both the legal entity explicit, and also provides a class of stock [Axis].

Edgar Filer Manual Section: The EFM states in essence that if you do not specify which class of stock a fact relates to, then it is implied that the fact relates to all classes of stock; basically implying a class of stock [Axis]. This seems to be consistent with how the legal entity axis works.

Scenario E: Legal Entity [Axis] is Implicit, Class of Stock [Axis] Implicit: This SEC filer provides neither a legal entity nor a class of stock [Axis]; however, because of the SEC rules both these [Axis] can be implied.

Scenario F: Legal Entity [Axis] is Implicit, Class of Stock [Axis] Implicit; Scenario [Axis] is explicit: This SEC filer provides neither a legal entity nor a class of stock [Axis]; however, because of the SEC rules both these [Axis] can be implied. This filer does, however, provide a scenario [Axis] explicitly.

Edgar Filer Manual Section: It seems to be the case that if no scenario [Axis] is provided, that the scenario us-gaap:ScenarioUnspecifiedDomain is implied per the EFM.

Scenario G: Document information and entity information in separate [Network]s: The majority of filers report document and entity information within the same network. Yet here, two filers report document information in one network and entity information in a different network. From a business semantics perspective, as can be seen from the [Axis] of the facts; which network is used makes no difference in the characteristics of the information.

Scenario H: Does the Entity Registered Name, Document Type, or Document Fiscal Year Focus Really have a Class of Stock?: The [Member] or value of an [Axis] articulates a characteristic of a fact. An [Axis] relates to an entire fact table. Does it really make sense that concepts such as entity registered name, amendment flag, document type, and document fiscal year focus to have a class of stock [Axis]? Or, would it make better sense to model facts which share characteristics in on [Table] and other facts with different characteristics in a different [Table]?

The Bottom Line:

Does cash and cash equivalents, receivables, payables, long term debt, or other such balance sheet line items have a class of stock? If you model a balance sheet with a class of stock [Axis] that is precisely what you are articulating. What does have a class of stock is preferred and common stock, not the entire balance sheet.

This is just like property, plant, and equipment or debt or some other detailed disclosure being modeled with an [Axis] differentiating the classes of that line item; but the balance sheet itself does not have that [Axis], only the disclosure does.

The document and entity information is pretty basic, but thinking about the characteristics which are associated with these basic facts can help you grapple with other more complex areas of an SEC XBRL financial filing. Think about the semantics of what you are communicating.

Reader Comments