Financial Disclosure Algorithms

When an external financial report is created a disclosure checklist is many times used by external reporting managers, auditors, and other accountants involved as a memory jogger to make sure the financial report is created correctly. For example, here is a disclosure checklist provided by EY for reporting under International Financial Reporting Standards (IFRS).

Disclosure checklists are generally used after a financial report has been created.

But what if something different was done. What if software for creating external financial reports could read these disclosure requirements and then guide accountants through the process of creating a financial report? Seem odd?

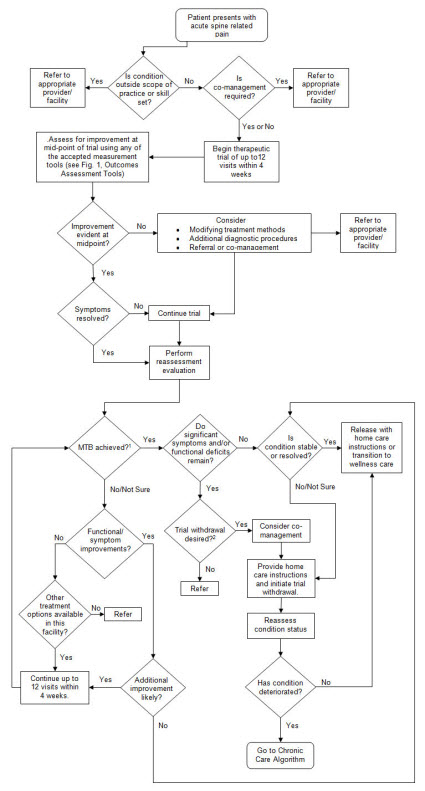

Consider this acute care algorithm used by chiropractors which was created by the Council on Chiropractic Guidelines and Practice Parameters (CCGPP):

What is similar sorts of algorithms existed for financial disclosures? What if these algorithms were not only readable by humans like the diagrams above, what if they were readable by computer software? What if software could guide an accountant through the process of creating the disclosures of a financial report similar to the way TurboTax guides someone through the process of creating a tax return.

It is my prediction that this is where not only financial reporting is going but where reporting in many other domains is likewise going.

Perhaps accountants and others in other domains are not used to this sort of an approach and perhaps the advantages of such an approach are not understood by the masses yet. But the advantages will be understood when business users can compare this sort of an approach with current approaches.

The challenge here is that a boatload of metadata needs to be created in order to properly drive software applications. This is why I have been creating things like my list of financial reporting topics and financial report disclosures for a number of years. Testing, tuning, prototyping. The financial report ontology ties all these things together.

Why can what I am talking about work? How would it work? The video How XBRL Works explains how and why this can be achieved now and also why it was harder to achieve this sort of functionally in the past. The bottom line is that financial reports of the past were big "chunks" organized by presentation structure.

Now because of XBRL, financial reports can be digital. Rather than a few big chunks of things organized for presentation; a digital financial report, such as an SEC XBRL financial filing, is thousands and thousands of little pieces which are individually identifiable by a computer software application which are organized by meaning. The first level of meaning is information about the report itself. That report level meaning is shared across business reporting domains.

The next level, such as these high-level concepts, is the information within the domain itself.

The financial disclosure algorithms are things like "IF...THEN" statements such as "IF the line item property, plant and equipment exists on the balance sheet, THEN the estimated useful lives of each class of property, plant, and equipment MUST be disclosed."

This idea can be hard to grasp because the tool of choice for creating financial reports today, Microsoft Word, knows nothing about creating financial reports. Disclosure management software will change this.

Reader Comments