Understanding the Problem of Changing a Concept Class

An all-to-common problem in SEC XBRL financial filings is a filer moving a concept which was defined as a part of one concept and using the concept as part of some other concept. This blog post explains that issue and shows why this is a problem.

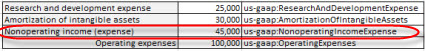

First, consider these three concepts: (human readable HTML and machine readable XML files are provided which show the details of these three income statement concepts)

- us-gaap:OperatingExpenses - (HTML | XML)

- us-gaap:NonoperatingIncomeExpense - (HTML | XML)

- us-gaap:InterestAndDebtExpense - (HTML | XML)

Each of these concepts is a relatively high-level part of an income statement. To make the point clear, let me provide a rather extreme example. Would it be appropriate for a filer to provide the subtotal "us-gaap:OperatingExpenses" in their filing, and then to provide the concept "us-gaap:NonoperatingIncomeExpense" as a part of us-gaap:OperatingExpenses? This screen shot below shows what I am trying to explain:

Does this make any sense? Including nonoperating income (expense) as part of Operating expenses? Of course it doesn't. Obviously this is an extreme example.

But does it make sense to include Interest and debt expense as part of Nonoperating income (expense)? Some SEC filers have done that. Or, does it make sense to include Interest Expense as part of Nonoperating income (expense)?

This discussion has nothing to do with materiality or any such reason. The point which I am trying to get you to focus on is the problem of defining something and then using what you defined as if it were something else. Saying that doing this is OK is basically allowing any filer to use any concept anywhere. The ramifications of this sort of arbitrary use of concepts is no possibility of creating software applications which can make use of information reported in digital financial reports using automated processes.

While the US GAAP XBRL Taxonomy does not explicitly define these "class-subclass" type relations, it implicitly does so. The XBRL calculation relations define relations between concepts.

Should filers be able to more some relations? Maybe. But clearly other types of relations would never change. Can a filer change this relation: Assets = Current assets + Noncurrent assets? Of course not. But at least one filer used the concept "us-gaap:AssetsNoncurrent" as a part of "us-gaap:OtherAssets".

Watch out for and avoid situations such as this.

Reader Comments