Wonderful Things XBRL-based Structured Information Enables

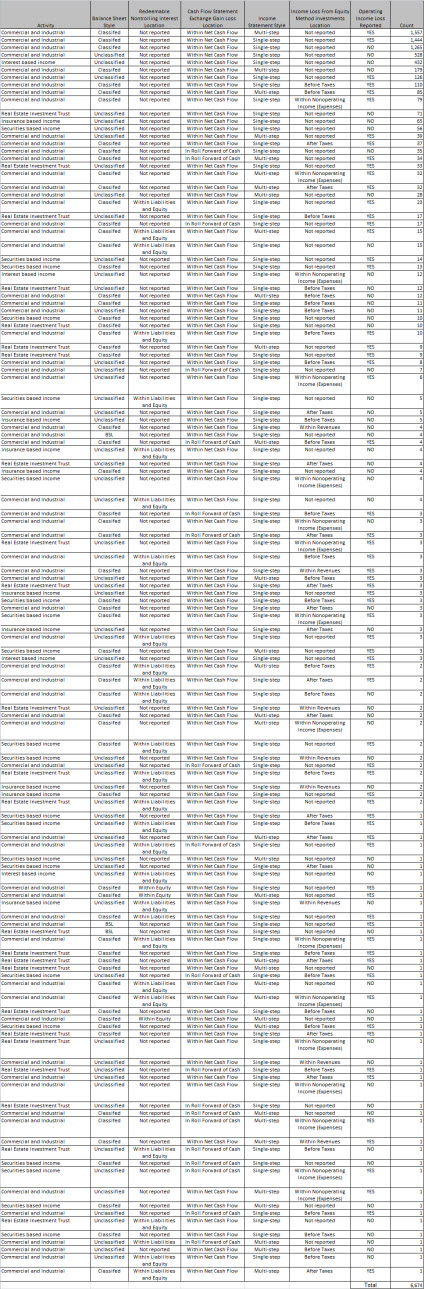

Oh the wonderful things XBRL-structured information enables. This is not earth shattering information by any means, but what is earth shattering is that it is almost becoming trivial to do queries which return information like the following:

- Of all SEC filers, 77% report using a classified balance sheet, 23% use an unclassified balance sheet. There are 6 which report on a liquidity basis.

- Of all SEC filers, 69% use a single-step income statement, 31% use a multi-step income statement.

- Of all SEC filers, 6,092 do not report "Income (Loss) from Equity Method Investments". Of those filers that do, 314 report the line item before tax, 101 report it after tax, 16 report it as part of revenues, and 151 report it as part of nonoperating income (expenses)

Below is a screen shot of some quick and dirty queries that I created to try and understand the way public companies report. This may not make total sense or it may not be interesting for your analysis purposes, but it is useful for what I am working on. Click on the image to check it out. Or, grab this ZIP file which has an Excel spreadsheet with the information. I even created a handy pivot table you can play with.

Enough said. I will let the demo speak for itself.

Reader Comments