XBRL-based Public Company Reports to SEC are 88% Correct Per One Measurement

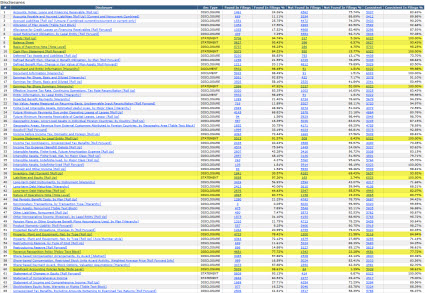

A measurement of XBRL-based public company financial reports to the SEC that I have made indicates that those reports are about 88% consistent with what I would expect. That said, the measurement is per a sampling of 65 disclosures for all 6,023 public company 10-K filings for 2016 and I cannot call this a verifiably scientific set of results. However, if anyone has a better measurement I would love to see that measurement.

Here are the details:

(Click image for larger view)I am just starting a journey that will be very similar to the measurement of the fundamental accounting concept relations that I have been taking. Those measurements are more precise and indicate that 99.19% of those relations are consistent with expectation. There are currently 5,271 of 6,000 reports or 87.9% of all reports that are consistent with all 22 of the fundamental accounting concept relations.

(Click image for larger view)I am just starting a journey that will be very similar to the measurement of the fundamental accounting concept relations that I have been taking. Those measurements are more precise and indicate that 99.19% of those relations are consistent with expectation. There are currently 5,271 of 6,000 reports or 87.9% of all reports that are consistent with all 22 of the fundamental accounting concept relations.

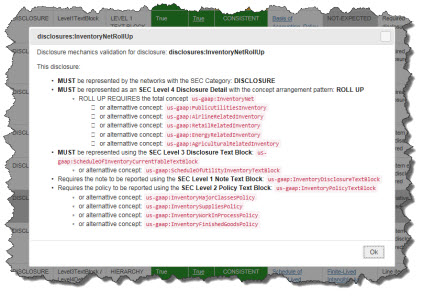

Right now I am calling this measurement the "Disclosure Mechanics" of a disclosure. If you want to understand this in detail, please go read Understanding the Mechanical Rules of Disclosures. Here is the crash course. First, I create logical, structural, and mathematical relations information in machine-readable XBRL format.

That rule in human-readable form looks like this:

(Click image for larger view)There are similar rules for 65 disclosures. Software uses the rules (currently there are two commercial implementations) to check disclosures. Here is the explanation mechanism provided by one of the commercial implementations:

(Click image for larger view)There are similar rules for 65 disclosures. Software uses the rules (currently there are two commercial implementations) to check disclosures. Here is the explanation mechanism provided by one of the commercial implementations:

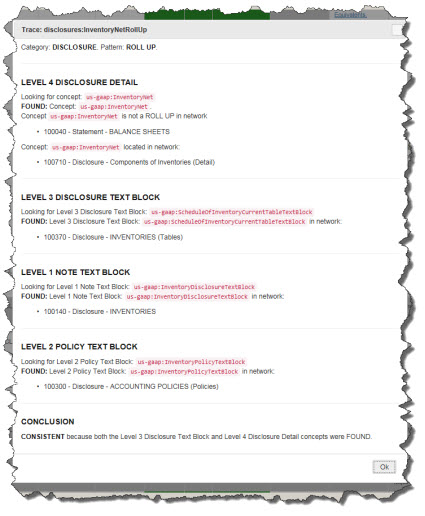

(Click image for larger view)The results are summarized and either a disclosure is consistent with expectation or inconsistent with what was expected. There are THREE REASONS an inconsistency might occur:

(Click image for larger view)The results are summarized and either a disclosure is consistent with expectation or inconsistent with what was expected. There are THREE REASONS an inconsistency might occur:

- The filing has an error that needs to be corrected.

- The US GAAP XBRL Taxonomy has an error that needs to be corrected.

- My test or the software algorithm has an error that needs to be corrected.

How do I know I am getting the results right? Observed empirical evidence from the XBRL-based reports themselves. Here is an example of that for the inventory components disclosure. I have some really good tools that I have created and perfected. Also, there are commercial tools that are becoming available. I helped XBRL Cloud create this tool for checking Disclosure Mechanics rules. Tools will continue to improve and evolve.

Over time these errors are corrected and the consistency rate increases, just like they did for the fundamental accounting concept relations. Harmony increases in the system, information quality goes up. What is the quality goal? In my view, the goal is Sigma Level 6 which is 99.99966% consistent with expectation. Right now we are between Sigma Level 2 and 3.

If you want to know more about creating zero-defect XBRL-based reports, please read Blueprint for Creating Zero-Defect XBRL-based Digital Financial Reports.

If you have some tool ideas, please send me an email.

Reader Comments