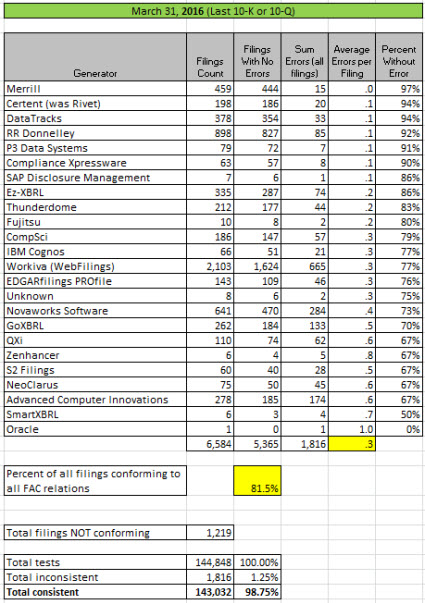

Here is this month's quality report of XBRL-based public company financial filings to the SEC. To remind you, I am measuring these reports against a set of basic, fundamental accounting concept relations. Below is the summary by generator (software vendor/filing agent) and what percentage of their reports are consistent with all of these basic, fundamental accounting concept relations:

(Click image for more information)

(Click image for more information)

This month I added a few new features to this information. This is the summary:

- Dashboard: I provided a dashboard to make it easier to consume the information.

- Three Year Comparison: I have been measuring this information over a three year period. This shows a comparison between each of the last three years.

- Month-to-Month Comparison for the past Year: This shows a comparison for every month of the past year except for April which I guess I did not measure. This is another view of the same information.

- Inconsistencies by Test: This lets you look at the measurement results on a test-by-test basis.

- Summary if Individual Inconsistencies: This provides details of about half of the XBRL-based reports that have inconsistencies and a description of the inconsistency. There is also a link from the inconsistency to the report that contains the inconsistency so you can go look at the report yourself. Here is a stand alone version of that list.

- Download Summary of Individual Inconsistencies: This is an Excel spreadsheet that has the 708 inconsistencies so you can examine the sorts of things that are causing quality issues.

Here is a summary of the inconsistencies by type of inconsistency with the code used for that type of inconsistency and a count of the number of such inconsistencies:

- UseOfIncomeLossFromContinuingOperationsIssue: 100 filers use the concept "us-gaap:IncomeLossFromContinuingOperations incorrectly. Most use this concept incorrectly to represent the line item "Operating Income (Loss)".

- InappropriateExtensionConcept: 93 filers create inappropriate extension concepts.

- NetCashFlowFromConceptIssue: 68 filers use the concept us-gaap:NetCashProvidedByUsedInContinuingOperations inappropriately.

- ContridictoryRevenueFacts: 52 filers report a revenues related fact that contradicts another revenues fact that they reported.

- InappropriateApplicationOfDimensions: 49 filers apply XBRL dimensions inappropriately.

- ReversedPolarityOfFact: 43 filers entered a negative number that should have been positive; or a positive number that should have been negative.

- UseOfOtherCompIncomeConceptCompIncomeIssue: 37 filers used one of the other comprehensive income concepts to represent comprehensive income.

- ReversedEquityConceptsIssue: 37 filers used the parent equity concept to represent total equity and the total equity concept to represent parent equity.

- InappropriateUseOfAssetsNoncurrent: 32 filers use the concept "us-gaap:AssetsNoncurrent" incorrectly and in conflict with the balance sheet. Generally, the majority confuse that concept with the concept "us-gaap:NoncurrentAssets" which is used to represent long-lived assets in the geographic area disclosure.

- InconsistentLoanLossProvision: 30 filers that use interest-based reporting provide contradictory concetps related to their provision for loan losses.

- InappropriateUseOfOperatingExpenses:25 filers are using the concept "us-gaap:OperatingExpenses inappropriately.

- WholePartIssue: 24 filers use a WHOLE and a PART in a way that is inappropriate. For example, a filer might use the concept "us-gaap:Revenue" which is the WHOLE, and then another revenues concept as a sibling to "us-gaap:Revenue".

- NetCashFlowRelatedIssue: 22 filers have a conflict between continuing, discontinued, and continuing plus discontinued operations facts.

- InappropriateUseLiabilitiesNoncurrent: 22 filers use the concept "us-gaap:LiabilitiesNoncurrent" inconsistent with its meaning.

- TemporaryEquityIssue: 19 filers have an issue related to temporary equity.

- ConflictingNetIncomeLossFacts: 12 filers have an inconsistency between the facts Net income (loss) and Net income (loss) attributable to parent.

- ReversedConceptsProfitLossNetIncomeLoss: 12 filers reversed the concepts "us-gaap:ProfitLoss" and "us-gaap:NetIncomeLoss".

- ReportsPreferredStockOutsideEquity: 8 reported preferred stock outside equity (preferred stock is always part of equity).

- SuccessorPredecessorIssue: 6 filers report successor/predecessor information inappropriately.

- MixesPartnershipCorporationNetIncomeConcepts: 6 filers mix the use of partnership and corporation net income concepts.

From that dashboard you can get to the crash course in the fundamental accounting concept relations so that you understand what they are and how they work. Need more details? Check out the updated Digital Financial Reporting Principles document.

* * * PRIOR RESULTS * * *

Previous fundamental accounting concept relations consistency results reported: February 29, 2016; January 31, 2016; December 31, 3015; November 30, 2015; October 31, 2015; September 30, 2015; August 31, 2015; July 31, 2015; June 30, 2015; May 29, 2015; April 1, 2015; November 29, 2014.