Conformance to Fundamental Accounting Concept Relations Doubles

(Note that information on discovering and correcting issues found by using the fundamental accounting concept tests can be found here.)

Two incredibly positive things have happened with regard to SEC XBRL-based financial filing quality. First, as part of my minimum criteria testing for fiscal year 2013, my data shows that 1,711 of 6,674 or 25.6% of all filers passed all of the fundamental accounting concept relations tests.

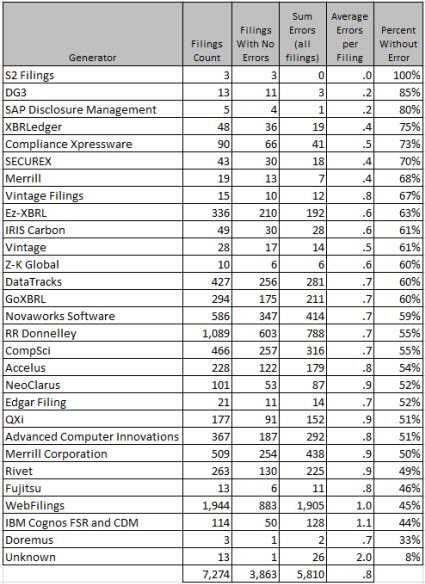

I just ran that same test and the rate is 53.1%! A total of 3,863 filings from the complete set of 7,274 SEC filers who filed a 10-Q for fiscal year 2014/2015 pass 100% of the fundamental accounting concept relations tests.

This is the breakdown by generator that my data shows: (note that this is approximatly that same breakdown as of March 2014; it is an approximation because it shows all of the minimum criteria)

The second positive thing is that XBRL Cloud has implemented my fundamental accounting concepts relations tests within their EDGAR Dashboard. Currently, only XBRL Cloud customers have access to the validation results as it is in BETA, from what I understand the fundamental accounting concept validation will make its way to the publicly available dashboard page eventually.

Now, these fundamental accounting concept relations validation results have only been avaiable for less than a week or so. That is important to know because that means most of the filers have not had their filings corrected as of the time my testing was done. What that means, it seems to me, is that there will be yet another significant increase in conformance to the fundamental accounting concept relations as XBRL Cloud customers make use of these new tests. I would assume that XBRL Cloud has a lot of customers, therefore there should be a lot more filings which conform to the fundamental accounting concept relations rules.

That means three things:

- There will be even more pressure on the half that don't follow these basic relations which no one really disputes.

- Data quality will rise as a result.

- Less human effort will be required to fix broken data thus doing the necessary expensive manual work to correct the bad data will cost significantly less.

Not sure if you are following me. But fundamentally it means this: the business model of data aggregators is about to shift. It will cheaper to fix the broken XBRL-based data than it will be to continue with the legacy approaches to making this data available.

I really don't know what caused the conformance to the fundamental accounting concept relations to increase so dramatically. I would like to think that my pestering software vendors and filing agents had something to do with it. SECXBRL.info publishing the same data probably helped. A few other software vendors implemented these also. Nothing that the FASB or SEC has done would explain this dramatic increase.

What do you think explains the dramatic quality increase?

Reader Comments