Understanding Important Connection Between Global LEI, XBRL Taxonomies, Conceptual Frameworks

There is an effort to create a global legal entity identifier. There are very important connections between all of the following things and it is important to understand that interconnectedness:

- Global Legal Entity Identifier, Parts of a Legal Entity

- XBRL Financial Reporting Taxonomies

- Financial Reporting Conceptual Frameworks

I mentioned the paper, An analysis of fundamental concepts in the conceptual framework using ontology technologies, written by Marthinus Cornelius Gerber, Aurona Jacoba Gerber, Alta van der Merwe; in a prior blog post. The paper points out then when textual manuscripts are used to describe things in a conceptual framework the descriptions can be vague, inconsistent or ambiguous. Machine-readable ontologies offer better percision. The paper states the following in the conclusion:

"From the first version of the artefact construction of an ontology-based formal language for the Conceptual Framework, there is evidence that the construction of a formal language using ontology technologies could play a substantial role to enhance the quality, clarity and re-usability of the Conceptual Framework definitions. Ontology statements are explicit and precise, and consequences of assertions can be exposed using reasoning technologies."

Here is an example of where ontologies can help. In another blog post and in a document I wrote, Differentiating Alternatives from Ambiguity, I pointed out specific inconsistencies that exist in US GAAP which were pointed out by the Wiley GAAP 2011 (page 46 to 48). In that resource, the authors make the following statement:

"Since these requirements do not utilize a common taxonomy, the following explanation will be referenced throughout Wiley GAAP."

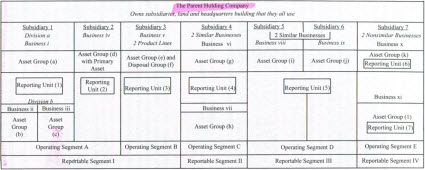

And then, they provide this graphic below that shows their resolution to the inconsistencies in US GAAP:

In today's digital world, we need this type of information in machine-readable form and we need this information to be represented correctly and precisely for machines such as computers to help us perform tasks we need them to perform.

To achieve this end, professional accountants need to learn a few things about knowledge engineering basics. This will enable professional accountants to both understand why we need this information in machine-readable form, enable them to work with knowledge engineers and information technology professionals to express this information correctly, and enable professional accountants to both maintain this information and add even more information to the base machine-readable representations.

Digital financial reporting is coming. Public companies, software vendors, and the U.S. Securities and Exchange Commission are perfecting digital financial reporting. Getting important standard identifiers like the global legal entity identifier right, getting the breakdown of entities right, and getting other such machine-readable information right is important.

(The link to LEI.INFO is https://lei.info)

Reader Comments