Finding More Accounting Errors in SEC Filings

I mentioned that as a result of some work that I am doing, I am noticing accounting/reporting errors that public companies are making and their auditors appear to be missing in reports that I analyze. Here is another example. I am analyzing future minimum payments due under non-cancelable leases of a lessee which is a relatively simple and very standard disclosure.

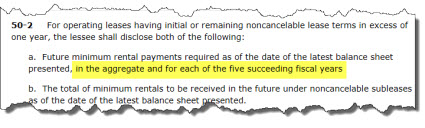

The Accounting Standards Codification (ASC) clearly states (840-20-50-2): (example ASC provides, link to example in ASC)

Notice how the accounting rules state, "..., in the aggregate and for each of the five succeeding fiscal years."

Further, the Wiley GAAP Guide disclosure checklist, the AICPA disclosure checklist, the KPMG disclosure checklist, and the Loscalzo Associates disclosure checklist all state exactly the same thing.

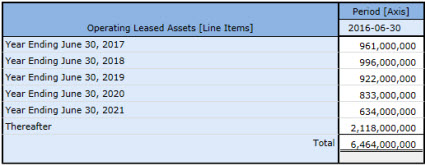

I can point you to 2,995 public companies that make that disclosure precisely as described in the ASC. Here are 110 examples of what I would consider best practice representations of what both the Level 3 Disclosure Text Block and the Level 4 Disclosure Detail should look like. Basically, they all look like what is shown below; several line items and then a total of those several the line items:

(Click to view disclosure in XBRL Cloud Viewer)

(Click to view disclosure in XBRL Cloud Viewer)

But, in my process of debugging the rules I am using to test this; I have run across 11 public companies that don't provide that total. (i.e. "the 'in the aggregate' piece in the ASC). Here are those 11 public companies which appear to have reporting errors: (click the link to view the disclosure in the XBRL Cloud Viewer)

- CHIASMA, INC (Donnelley) (Deloitte) (10-K)

- Conduent Incorporated (Workiva) (PWC) (10-K)

- GENERAL MOTORS COMPANY (Workiva) (Deloitte) (10-K)

- IEC ELECTRONICS CORP (Workiva) (Crowe Horwath) (10-K)

- LTC PROPERTIES INC (Merrill) (EY) (10-K)

- MARSH & MCLENNAN COMPANIES, INC. (Workiva) (Deloitte) (10-K)

- MCCORMICK & CO INC (Workiva) (EY) (10-K)

- NCI BUILDING SYSTEMS INC (Workiva) (EY) (10-K)

- RBC Bearings INC (DataTracks) (EY) (10-K)

- TRANS WORLD CORP (Merrill) (WithumSmith+Brown) (10-K)

- United Insurance Holdings Corp. (Workiva) (RSM US) (10-K)

I have run this by several other CPAs and all of them read the ASC the same way that I do. Now, honestly, I find that ASC description somewhat lacking. It does not seem to discuss the "thereafter" line item. It talks about the "five succeeding fiscal years" but it does not mention the "thereafter" line item which is necessary.

I ran across another error in the US GAAP XBRL Taxonomy. The US GAAP XBRL Taxonomy appears to be missing a Level 3 Disclosure Text Block that relates to the lessor disclosure of future minimum payments receivable. The US GAAP XBRL Taxonomy only seems to provide the lessee disclosure. That is a different disclosure, but I ran across 46 public companies that were using the same Level 3 Text Block (i.e. for the lessee disclosure) for the lessor disclosure. Those are two different disclosures so they really need two different text blocks.

It is looking like Marthinus Cornelius Gerber, Aurona Jacoba Gerber, and Alta van der Merwe were correct. In their paper, An analysis of fundamental concepts in the conceptual framework using ontology technologies, they explain how an ontology can be used to check the conceptual framework of a reporting scheme. I am using a conceptual model and lots of business rules. But in essence, we are doing the same thing.

Also, this is one step closer to what Jun Dai and Miklos Vasarhelyi of Rutgers University call Audit 4.0 in their paper, Imagineering Audit 4.0.

Granted, what I am doing is still rudimentary, but it is definitely a start.

Welcome to the Digital Age of accounting, reporting, and auditing.

Reader Comments