BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from August 1, 2018 - August 31, 2018

General Ledger Trial Balance to External Financial Report

I am continuing to piece together a complete financial reporting solution and explain my approach. The most current iteration is this document, General Ledger Trial Balance to External Financial Report.

That document combines information from my first and second explanations. The ultimate goal is to create the framework for implementing a modern finance platform using 100% global standard XBRL technical syntax.

If you want to understand all this, I would recommend three documents:

- Computer Empathy: This document provides you with critical background information. If you are an accountant trying to understand all this using the historical financial reporting paradigm you will never understand. The key word here is "digital"; accounting, reporting, auditing, and analysis in a modern digital environment.

- Putting the Expertise into an XBRL-based Knowledge Based System for Creating Financial Reports: I am not "paving the goat path" and replicating existing inefficiencies related to old-school paper-based reporting in XBRL-based digital financial reporting software. We are choosing to take a different path. One type of practical knowledge is know-how; how to accomplish something. This document helps you understand how to build a modern finance platform. The key word here is "patterns". Good software engineers understand that patterns provide leverage.

- Blueprint for Creating Zero-defect XBRL-based Digital Financial Reports: This document helps you understand how machine-readable rules are used to keep quality ultra-high. Quality will be better than the quality of current processes, procedures, techniques, and philosophies and with lower costs through process automation. The key phrase here is that "business rules prevent information anarchy."

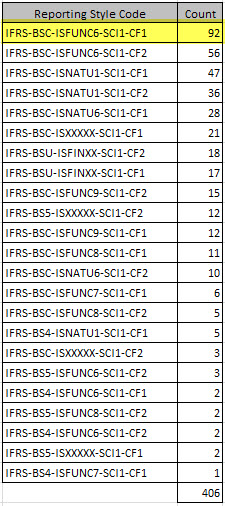

Steven Covey, in his seminal book The Seven Habits of Highly Effective People, says "Begin with the end in mind." (Habit 2). What is the end? Well, these 5,734 US GAAP financial reports and these 406 IFRS financial reports are the end.

If you believe that accounting, reporting, auditing, and analysis will be done in an increasingly digital environment as contrast to the current old-school processes created for paper-based reporting; you may want to wade through the notes that I have been taking for the past 20 years: Intelligent XBRL-based Digital Financial Reporting.

Brand new to XBRL? How XBRL Works is a popular video that explains the basics.

Comprehensive Analysis of IFRS-BSC-ISFUNC6-SCI1-CF1 Reporting Style

I am going to do a comprehensive analysis of each of the IFRS reporting styles that are used by the 406 listed companies that submit reports to the SEC. The analysis will use POSITIVE and NEGATIVE evidence to support each reporting style. The evidence includes a working validator that exercises the rules of the reporting style using an Excel spreadsheet that I created. I provide two spreadsheets: one for companies that pass 100% of tests and one that fails one or more tests. I also provide additional documentation. You can get the analysis of IFRS-BSC-ISFUNC6-SCI1-CF1 here in this ZIP file.

The bottom line is the following for this most popular reporting style:

- 98% of the information in the 92 XBRL-based reports is consistent with my machine-readable validation rules.

- 62% of filings are consistent with 100% of my machine-readable rules.

- I have provided high-quality documentation for 23 confirmed filer errors that is an excellent learning tool. (That is the same document that is in the ZIP file.)

- The documenation both explains the filer error and provides links to the actual SEC filing page of the report and to the XBRL Cloud Viewer that enables you to look at XBRL taxonomy information related to the filer error.

If you are not clear on what a reporting style is, I would encourage you to have a look at this documentation which explains each of those funny looking codes that make up a reporting style.

Below is a summary of the reporting styles of all 406 IFRS reports in the set of companies that I am analyzing. I am choose not to analyze all of these reporting styles, but I certainly will analyze the most popular reporting styles.

If you still don't grasp why I am going through all this trouble, you might want to read (or re-read) the Computer Empathy document. Trust me when I say that there is a method to my madness.

(Click image for detailed information about each reporting style)

(Click image for detailed information about each reporting style)