BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from November 11, 2012 - November 17, 2012

Semantic Financial Reporting

This is one of the more interesting things which I have run across. Epistematica's article A new approach for Digital Financial Reporting states (the emphasis is mine):

Epistematica has studied and experimented an original approach for the XBRL-based Digital Financial Reporting, that introduces the possibility of defining the semantics of financial facts.

This approach is based in a strongly logical knowledge representation that aims at running inferential processes to automatically extract knowledge that is implicit in balance sheets and notes.

This is exactly on target: make the implicit knowledge explicit and articulate this explicit knowledge using a format understandable by computer software.

They seem to be calling their approach "Semantic Financial Reporting". I like that term even better than Digital Financial Reporting.

Smart Regulation Graphic Shows the Big Picture

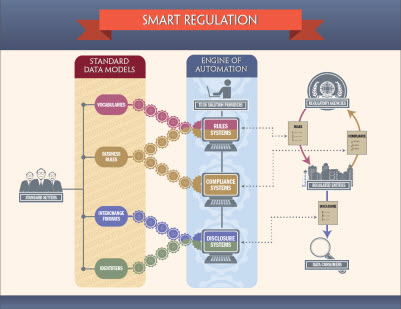

The Data Coalition has a great graphic which explains the pieces of what they call "Smart Regulation". Another term for this is algorithmic regulation.

Data Coalition, Smart RegulationIn the graphic, notice the center column, the "Engine of Automation". Excellent term. In order for the engine of automation to work and get the benefits to both regulators and those being regulated (in the right column) you need all the stuff in the left column (vocabularies, business rules, interchange formats, identifiers).

Data Coalition, Smart RegulationIn the graphic, notice the center column, the "Engine of Automation". Excellent term. In order for the engine of automation to work and get the benefits to both regulators and those being regulated (in the right column) you need all the stuff in the left column (vocabularies, business rules, interchange formats, identifiers).

The HL7 folks explained this as technical interoperability, semantic interoperability, and process interoperability.

Any system, yes any system, trying to make information exchange work effectively needs all these pieces. The reason the XBRL-based data in the SEC EDGAR system is not useful is because the FASB/SEC left some of these pieces out of their system.

XBRL is only the "interchange format" or part of the "technical interoperability" piece. XBRL provides a way of articulating the vocabulary and business rules, US GAAP is the vocabulary and business rules. The US GAAP Taxonomy left out many of the business rules. It is the missing business rules which causes most of the issues with the XBRL-based information in the SEC EDGAR system.

XBRL is excelling as an interchange format. At the technical syntax level, XBRL technical syntax is inter-operable globally. However, many systems leave out important business rules which makes the information less inter-operable at the business semantics level.