Signs of the Transparency to Come to Financial Reporting

Many people pushing XBRL as a digital financial reporting format point to transparency as one of the benefits of leveraging that technology. Well, you can get a glimpse of what they are talking about today. Admittedly there is a ways to go, but the path has been set and we are rapidly moving down that path.

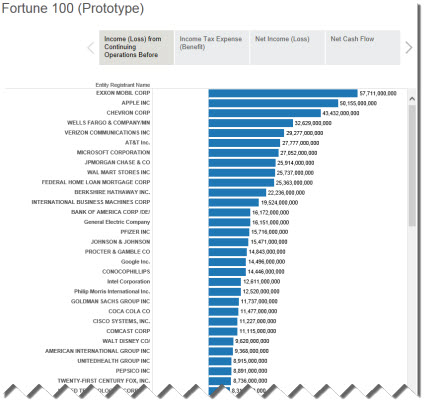

These are some visualizations and this is an accounting tool which I created using information obtained about SEC XBRL financial filings using off-the-shelf software provided by UBmatrix (Taxonomy Designer, XBRL Processor), XBRL Cloud (Edgar Report Information API), 28msec (SECXBRL.info API), Tableau (Tableau Public), and Microsoft (Access, Excel).

(Click to go to visualization)

(Click to go to visualization)

The visualization above are for report element extension and errors. This visualization shows Fortune 100 information(prototype). I am pulling information which I extracted from the SEC XBRL financial filing. If the filer reported it wrong or made me guess, reported information may show up in this visualization incorrectly. Personally, I don't think using this information should be or needs to be a guessing game.

(Click image to view visualization)

(Click image to view visualization)

So, people who want to get at this information can get the information. But, there are three pieces left as I see it:

- Improve quality. The quality of SEC XBRL financial filings needs to improve and they will. Transparency will help detect and correct errors. Something like this digital disclosure checklist will help reduce errors. The more business rules, the more which can be automated. Automating as much information verification is the key to information quality.

- Eliminate guessing game. Using this information should be safe, predictable, reliable, repeatable. Software vendors should not need to spend untold hours unraveling this information. That is costly and causes the system to be brittle. This information should be easy for a machine to interpret.

- Make things easier for business users. Admittedly I have a deep, deep knowledge of the moving pieces and am very fortunate to understand both the financial reporting aspects and the technology aspects at work. For that I am grateful to all those who have helped me over the past 15 years. But building these pieces needs to be easier for business users who have less knowledge, particularly technical knowledge.

This document, Digital Financial Reporting Principles, is my best effort at collecting and organizing information which can be used to improve quality, eliminate the guessing game, and making things easier for business users.

Think about the sorts of things you can see from these examples and from other software products and services which leverage the XBRL-based financial information mandated that public companies report to the SEC. Project from what you see to other possibilities. These are only a few examples.

While US financial reporting is on the leading edge of digital financial reporting, think of other domains where these same technologies and techniques can be applied. Think of other products which will likely be created by the market.

Don't let people fool you into thinking that all this is hard and has to be complex. It doesn't. Beat down complexity. If I can do this, others can do this also. If what you have been trying seems hard or complex, try something different.

Two quotes from Albert Einstein:

Insanity: doing the same thing over and over again and expecting different results.

Any fool can make things bigger, more complex, and more violent. It takes a touch of genius-and a lot of courage-to move in the opposite direction.

Simple is the ultimate sophistication. Simple is elegant.

The above examples will give you an idea of the level of transparency which is on the way. Empowering business users to employ these sorts of technologies and techniques is valuable.

Reader Comments