Value of the US GAAP Taxonomy

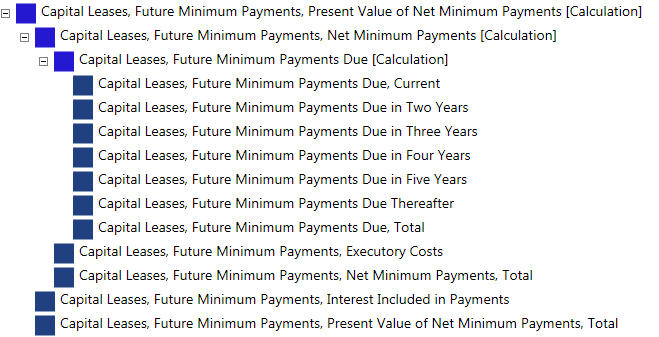

All to often, XBRL is seen as simply something they may need to file with the SEC because they have to. Here is an example of why this view is mistaken. Consider the following screen shot:

I remember back when I was in college trying to understand how to compute the present value of net minimum payments under capital leases. Intermediate Accounting was the class where I was exposed to this. I sort of got this then, enough to pass the class at least, and enough to pass the CPA exam. But look at this image above. How helpful is that, which is a tree presentation of what is in the US GAAP Taxonomy, at understanding how the present value of net minimum payments is calculated? I say quite helpful.

Now, I don't know about you, but (a) I am not very good at memorizing all this stuff and (b) frankly, I would consider myself a pretty average (at best) accountant. This stuff has been a HUGE help in understanding accounting. All laid out for you.

Another point is that I was fortunate enough to participate in the creation of both the US GAAP Taxonomy and the IFRS Taxonomy. (This was a great exposure into the world of IFRS for me). I noticed during the creation of the taxonomy that (a) the accountants did not always agree where things were supposed to go, at least at first, (b) may times people had their understandings incorrect. The best example of this was the creation of the income statement with all those "steps" toward arriving at "Net Income" (extraordinary items, discontinued operations, cumulative impact of accounting changes, and all that stuff). People would get those in the wrong order.

Particular for average accountants like me, the UGT is quite a reference resource. Even if you never use it to report a financial statement using XBRL, the UGT basically allows average accountants to more easily understand all this stuff. And for accounting students, it seems to me this is even better!

Reader Comments (1)

There are two different financial reports on two different companies, one using US GAAP and the other using IFRS - does XBRL allow a comparison of this data? Do both financial reports need to use the same taxonomy (either GAAP or IFRs)?