SEC XBRL Edgar Data: Has a Beachhead Been Established?

It seems to me that a beachhead has been established by the SEC XBRL financial filing data set. This is particularly worthy of mention because from what I can tell, there really isn't even a beach master. While the SEC certainly has a lot to do with the success of getting their new XBRL-based EDGAR system up and running, I think there are others who are quite instrumental to this process also. Clearly the FASB plays a big role, they maintain the US GAAP Taxonomy used by the filers. XBRL US who got the initial version of the US GAAP Taxonomy is still contributing. The software providers and filing agents, of which there appear to be at least 15 that I can count, are stepping up to the plate. The filers themselves are pushing on the system, moving things in the right direction if only by caring about the XBRL that they submit. And, of course, the SEC itself contributes in two ways. First, directly by guiding the process and second by letting the others, the market, figure this XBRL thing out.

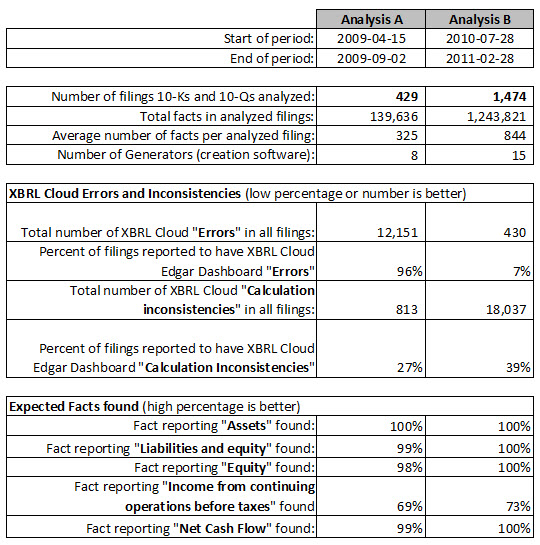

XBRL International and its members has also made quite a contribution. If you really think about it; at least 15 different software vendors and my set of 1474 filingsall readable by a software application created by a CPA with limited programming skills (that would be me) in Microsoft Access. Clearly commercial quality software will do the heavy lifting of making the XBRL-based information useful for multitudes of purposes, but simply being able to successfully read the individual files is success as far as I am concerned.

Sure, there is a lot of improvement needed before success can be declared. And we need to get the next tier of 8700 or so filers into the system. But from what I can see happening, I am optimistic about this next big increase in SEC XBRL filing volume.

Information from my analysis can be found here. The table below summarizes the key points. My focus is on basic consumption of the files and being able to gather foundational financial information. Assets. Liabilities and Equity. Total Equity. Income from continuing operations before taxes. Net cash flows. I would expect all of these concepts and I do see what I would have expected within the latest set of SEC XBRL financial filings.

What is your view? Are your expectations being met? Do you think a beachhead has been established? If so, why. If not, why not? Is the vision set by ex-chairman Christopher Cox and his team materializing?

Reader Comments