XBRL for Intellectual Capital Statements

Someone posted a comment on one of the XBRL related groups that I belong to stating that XBRL might be a good tool for articulating intellectual capital statements.

Well, I did not know what an intellectual capital statement was or how to create one. So, in doing some checking these are a few resources that I came up with:

- Intellectual capital statement, a definition

- A Guideline for Intellectual Capital Statements, a key to knowledge management

- Constructing Intellectual Capital Statements

- Intellectual capital (Wikipedia)

- Knowledge management(Wikipedia)

- History of intellectual capital movement

- Reading an intellectual capital statement

- Measuring intellectual capital

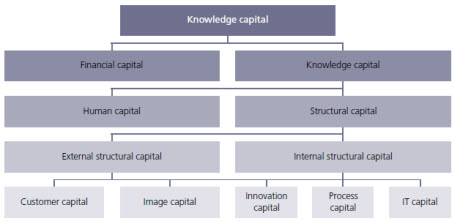

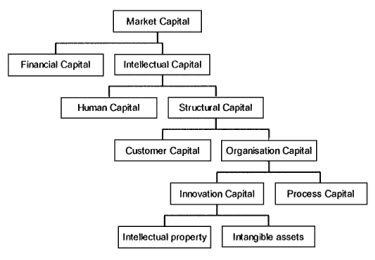

The articles above (#2 and #3) provide different visualizations which help to understand what intellectual capital is or categorizations of intellectual capital:

First:

Second (Edvinsson’s and Sveiby’s models of intellectual capital):

A concise definition of intellectual capital is provided by #2 above as:

The market value of the company (i.e. market capitalisation) minus the book value. In

conjunction with intellectual capital statements, the intellectual capital is often constituted

by the grand total of customers, organisation and individual capital. It is also named

knowledge capital. See also book-to-market value.

Imagine a searchable semantic database of external intellectual capital statements for every company.

Interesting.

Reader Comments