Trouble with Text Blocks in SEC XBRL Financial Filings

An analysis of the US GAAP XBRL Taxonomy network related to disclosing leasespointed out some rather significant issues related to [Text Block]s in SEC XBRL financial filings and in the US GAAP XBRL Taxonomy. This is a summary of what I discovered:

- Mismatched [Text Block] and detailed disclosure sets: There are not matched sets of [Text Block] level disclosures and detailed disclosures. This is particularly true if you consider how SEC filers use the US GAAP XBRL Taxonomy to create their disclosures. Basically, there should be a [Text Block] level disclosure for every detailed disclosure.

- Note level [Text Block]s don't match and will never match SEC filer organization of disclosures into notes. The essence of this observation is that the US GAAP XBRL Taxonomy is supposed to be used to report disclosures, not how SEC filers organized those disclosures into their notes to the financial statements.

- US GAAP XBRL Taxonomy networks tend to be HUGE, SEC XBRL filer networks tend to be very small. The average size of an SEC XBRL financial filer's networks is approximately 10 concepts. The US GAAP XBRL taxonomy networks are significantly larger than this, they tend to be rather large. SEC filers tend to take the large networks of the US GAAP XBRL Taxonomy and break their disclosures into much, much smaller pieces. This helps the usability of SEC XBRL financial filings, but mainly because of the missing [Text Block]s, SEC filers create a lot of extensions related to [Text Block]s.

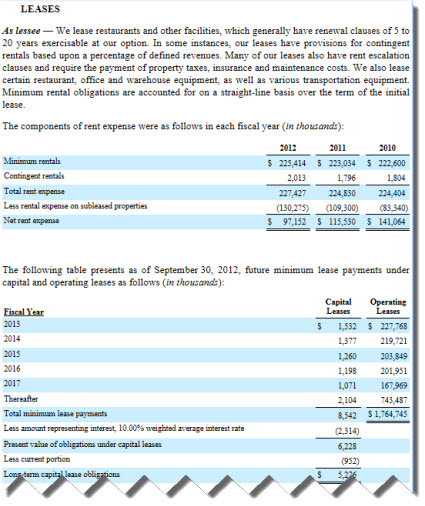

If you take a look a an SEC XBRL financial filing you can see what is going on. Consider this filing. If you go to note level disclosures you will see that this filer create the concept:

jack:LeasesOfLesseeAndLessorDisclosureTextBlock

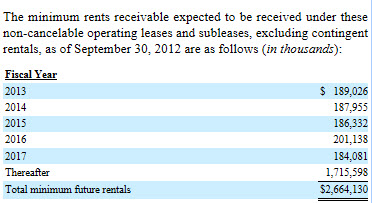

and used that for the [Text Block] which contains the entire note. And then for the [Text Block] which contains information for the specific disclosure of total minimum future rentals receivable, the filer used this concept:

jack:MinimumRentsReceivableExpectedToBeReceivedUnderTheseNonCancelableOperatingLeasesTableTextBlock

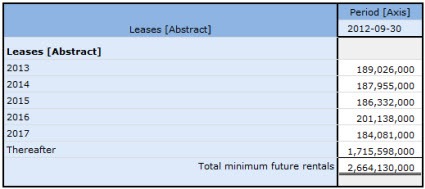

And then the detailed level no extension concepts where used because all of these are provided for in the US GAAP XBRL Taxonomy:

This is a common pattern which I saw for filers providing this disclosure.

You can go have a look for yourself here on this flat eash to scan rendering of the US GAAP XBRL Taxonomy. Or, go to the PDF above which has additional information.

Keep in mind that I am using the Leases network an example of a general problem with [Text Block]s. These same issues relate to pretty much every network.

Reader Comments