Mastering Digital Financial Report Disclosures

While comparing and contrasting the fundamental accounting concepts reporting entities use helps you understand and verify basic relationships which are generally reported on the primary financial statements; the same ideas apply to disclosures. This blog post will help you understand how to understand disclosures within a digital financial report such as an SEC XBRL financial filing.

Take the disclosure future minimum payments under capital leases. (Here is documentation which provides details of this information provided below; here is an Excel spreadsheet with the summary.)

In order to understand this disclosure I looked at the Fortune 100 companies which provided the disclosure future minimum payments under capital leases. There were 35 entities in the Fortune 100 which provided that disclosure. (The other 65 don't have this disclosure because they don't have capital leases.)

Of those 35 entities which have this disclosure I will use Delta Air Linesbecause they were one of 21 entities which I believe created a logical, rational, sensible representation of this information. So 60% of those 35 entities represented this information consistently in all aspects and also consistent with what US GAAP says as I understand it.

First, they will provide a Level 3 text block with this disclosure as required by the SEC. They will also provide a Level 1 text block, but I am not analyzing that, only the Level 3 text block and the Level 4 detailed disclosure. Here is that Level 3 text block for Delta: (us-gaap:ScheduleOfFutureMinimumLeasePaymentsForCapitalLeasesTableTextBlock)

From the analysis you will note that only 6 other entities which reported this disclosure used that concept. There were 24 entities which created an extension concept. Why? Well, because (a) they combined the presentation of the capital lease and operating lease future minimum payments disclosure and (b) there is no text block concept for that combined disclosure. That seems to indicate, perhaps, that there is a concept missing from the US GAAP XBRL Taxonomy.

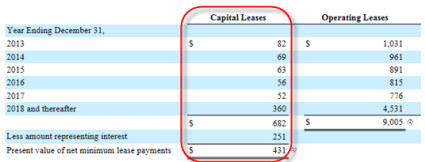

So, here is what the combined disclosure looks like (using American Airlines):

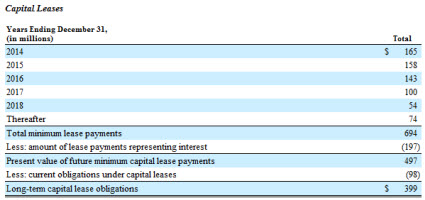

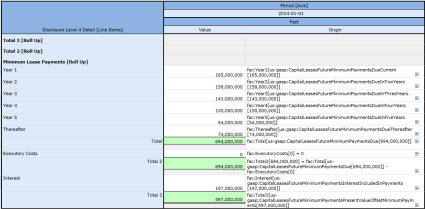

OK, back to Delta. They also need to provide a Level 4 detailed disclosure. Here is that information:

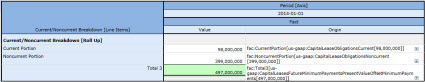

Notice that the numbers in the detail match the numbers in the text block. But that is not all of the numbers. Notice that at the bottom of the Level 3 text block there is a current/noncurrent breakdown of the total capital lease obligation. I show that separately, here is that part of the disclosure:

The reason I separate this is that personally, I consider this two disclosures. The first disclosure is the future minimum payments under capital leases. The second disclosure is the breakdown of the current and noncurrent portions of the total capital lease obligation. Sometimes the current/noncurrent breakdown ties to the balance sheet line items. Sometimes, as in Delta's case, it does not. Other times this can tie to other things.

This new tool provide by XBRL Cloud can help you visualize these pieces. It is worth checking out.

If you work through that analysis document (this PDF), you can see that comparing and contrasting how different reporting entities represent the same information and you can learn lots of useful things. Here are some things that seem straight forward to me:

- While there are 6 entities which use the prescribed concept, 24 entities combine the operating and capital lease disclosure and create an extension concept, 4 other combined operating and capital lease disclosures and us an OPERATING LEASE related text block, and a handful of others combined the capital lease disclosure with something else. What does that mean? Should all these permutations and combinations be added to the US GAAP XBRL Taxonomy? Or, alternatively, should the text block always be provided separately? Or, is there some other solution to this situation?

- The concepts us-gaap:CapitalLeaseObligations (which 12 filers use) and us-gaap:CapitalLeasesFutureMinimumPaymentsPresentValueOfNetMinimumPayments(which 19 filers use) appear to be representing exactly the same thing. Seems to me that one of these concepts should be removed from the US GAAP XBRL Taxonomy.

- It seems to me that US GAAP requires the disclosure of the current and noncurrent portions of the total capital lease obligation. Most filers provide this, 18 of the 35. A handful are not required to report the breakdown because they provide an unclassified balance sheet. You can sometimes sort this out by subtracting the long term debt portion from the long term debt and capital lease obligation portion to arrive at the capital lease obligation portion. But sometimes you cannot.

- The US GAAP XBRL Taxonomy provides concepts for the executory costs and interest portions which are used to arrive at total future net minimum payments. One filer includes the line item "unamortized fair value adjustment" in computation of net minimum payments. If that is correct, then there is a concept missing from the US GAAP XBRL Taxonomy. If it is not correct, then that is a reporting error. Two filers combined executory costs and interest. Is that correct? If so, that combined concept is missing from the US GAAP XBRL Taxonomy.

There is a lot more that can be gleaned from the analysis. There are also a lot of other documents which analyze disclosures here, see the section "Disclosures". Of particular interest are property, plant, and equipment components by type; property, plant, and equipment estimated useful lives; and long term debt maturities.

Those will set you on the right course for becoming a master of XBRL-based digital financial report disclosures. While I walked you through one disclosure, these same ideas apply to other disclosures also.

Reader Comments