Understanding US GAAP Reporting Styles

When you talk to most accountants you get the impression that US GAAP based financial reporting is random. Nothing could be further from the truth.

For example, how many public companies report balance sheets? The answer is that everypublic company reports a balance sheet, or more precicely a statement of financial position. What are the different styles that you can use to create a balance sheet? Well, since I looked at every balance sheet of every public company that reports to the SEC I can tell you:

- Classified balance sheetwhich breaks down assets and liabilities into their current and noncurrent portions. 5,343 public companies use that style.

- Unclassfied balance sheet which does not break outassets and liabilities into their current and noncurrent portions. 1,239 public companies use that style.

- Classified balance sheet alternative which is the same as the first style except that Noncurrent assets is broken down into "Fixed Assets" and "Other than Fixed Noncurrent Assets". There are about 88 public companies that use that style.

- Balance sheet that reports "Capitalization" which tends to be used by regulated public utilities.

- Liquidation basis statement of financial condition which is fairly rare and used by companies that are in the process of liquidating; also called a Statement of Net Assets. I don't have a precise count of this yet.

Do I have all of this 100% correct? Not yet. Are their other styles? Sure. But I am getting there. The same idea of reporting styles applies to the income statement, cash flow statement, statement of comprehensive income. I organized all this into what I am calling a Reporting Style Viewer (Prototype).

How helpful is organizing 100% of public company primary financial statement reporting styles to professional accountants? I contend that it is very helpful. It is helpful to me.

What about organizing all of the reporting styles for disclosures? Well, here is that also, I call it a Disclosure Library (Prototype).

Anyone else find this helpful?

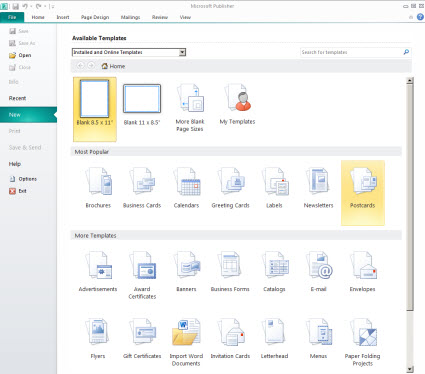

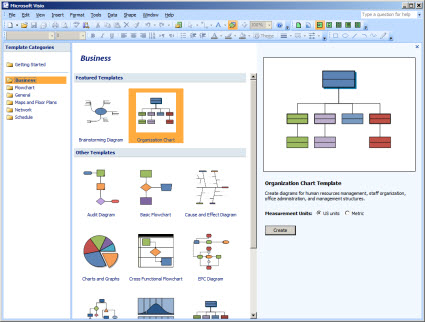

This organization is not really my idea. This is inspired by applications such as Microsoft Publisher and Microsoft Visio and many, many other software applications that have interface to work with selecting things. Here are screen shots for Publisher and Visio:

Publisher:

Visio:

How many accountants can point you to a list of every disclosure that exists? That is not the way accountants think about this stuff. But does that mean that you cannot create such a list? Or said another way, is there anything stopping someone from looking at every public company and reverse-engineering the complete list of disclosures? Why the heck would anyone go through the trouble to do that?

Well, why would anyone go through the trouble to organize Visio stencils?

When things are digital you get to think of things differently. Digital is not "software"; digital is a mindset. In the digital age, it helps to have a digital mindset.

If you have not read it already, you may want to go check out the document Understanding Blocks, Slots , Templates and Exemplars that I made available a while back.

Reader Comments