Explanation of a Financial Report Logical System in Simple Terms

The following is an explanation of a financial report logical system in simple terms. Please see the more complete explanation should you be interested in more details. The objective of this explanation in simple terms is to help professional accountants get their head around XBRL-based digital financial reports.

A logical system (logical theory) enables a community of stakeholders trying to achieve a specific goal or objective or a range of goals/objectives to agree on important common models, structures, and statements for capturing meaning or representing a shared understanding of and knowledge in some universe of discourse.

A financial report is a logical system. Financial reports represent economic phenomena in words and numbers. A financial report is a faithful representation of a set of claims made by an economic entity about the financial position and financial performance of an economic entity. (i.e. a financial report is not arbitrary, is not random, is not illogical)

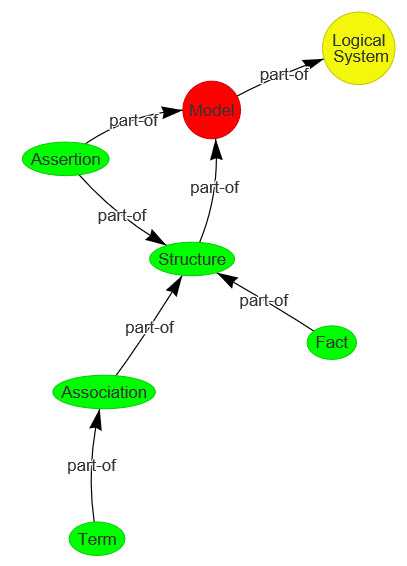

A logical system or logical theory is made up of a set of models, structures, terms, associations, assertions, and facts. In very simple terms,

- Logical theory: A logical theory is a set of models that are consistent with and permissible per that logical theory.

- Model: A model is a set of structures. A model is a permissible interpretation of a theory.

- Structure: A structure is a set of statements which describe the associations and assertions of the structure. (A structure provides context. A structure is a composite. A structure is used to partician.)

- Statement: A statement is a proposition, claim, assertion, belief, idea, or fact about or related to the universe of discourse to which the logical theory relates. There are four broad categories of statements:

- Terms: Terms are statements that define ideas used by the logical theory such as “assets”, “liabilities”, and “equity”.

- Associations: Associations are statements that describe permissible interrelationships between the terms such as “assets is part-of the balance sheet” or “operating expenses is a type-of expense” or “assets = liabilities + equity” or “an asset is a ‘debit’ and is ‘as of’ a specific point in time and is always a monetary numeric value”.

- Assertions: Assertions are statements that describe expectations what tend to be IF…THEN…ELSE types of relationships such as “IF the economic entity is a not-for-profit THEN net assets = assets - liabilities; ELSE assets = liabilities + equity”.

- Facts: Facts are statements about the numbers and words that are provided by an economic entity within their financial report. For example, “assets for the consolidated legal entity Microsoft as of June 20, 2017 was $241,086,000,000 expressed in US dollars and rounded to the nearest millions of dollars.

A financial report has a finite set of statements (structures, terms, associations, assertions, and facts) within the report. The set of statements is definite. That definite set of statements forms a model. (With any field of knowledge, the critical concepts of the field are embedded in the definitions of the field's technical terms. The term 'statement' in financial reporting is different than that same term 'statement' as is being used here.)

A logical system is said to be consistent if there are no contradictions with respect to the finite statements made by the logical system.

A logical system can have high to low precision and high to low coverage. Precision is a measure of how precisely the information within a logical system has been represented as contrast to reality for the universe of discourse. Coverage is a measure of how completely information in a logical system has been represented relative to the reality for a universe of discourse.

Finally, when information is exchanged it is important to agree on a "world view". You can agree on on the terms, structures, associations, assertions and facts; but nothing tells us how each of these statements will be processed, understood, or managed. This could be different in different systems. As such, some certain amount of the world view must be agreed to. Stakeholders should be conscious of these potential differences and agree on specific aspects of the world view.

(If you are finding this useful, I would encourage you to read the Special Theory of Machine-based Automated Communication of Semantic Information of Financial Statements.)

A visualization of the model described above is as follows:

(Click image for larger view)

If the models, structures, terms, associations, assertions, and facts have high precision and high coverage, and if all the statements within the logical system are consistent; then the logical system can be proven to be properly functioning. If you have a properly functioning logical system then you can create a chain of reasoning.

A very simple example of a logical system is the accounting equation. Here is a description of the accounting equation logical system in both human-readable terms and machine-readable terms using XBRL (here is documentation):

- Terms (Human | Machine): Three simple terms are defined: Assets, Liabilities, Equity. One complex term is defined, balance sheet.

- Associations (Human | Machine): The three terms are associated in that they are all PART-OF the balance sheet.

- Assertions (Human | Machine): A mathematical assertion is made that "Assets = Liabilities + Equity".

- Facts (Human | Machine): Instances of three facts are established to exercise the model: Assets of $5,000; Liabilities of $1,000; Equity of $4,000.

- Model: We created only one model, or permissible interpenetration, of the logical theory. As accountants know, if you reverse the equation using the rules of math to "Equity = Assets - Liabilities" and change the term "Equity" to "Net Assets"; then you get another permissible interpretation or model.

This document summarizes this simple explanation. All of the related details associated with the information is summarized here. This document is another example of applying these ideas.

If this explanation makes sense, this document, Elements of Financial Statements Defined by FASB in SFAC 6, will take you to the next level of understanding. This logical system and method works for any financial reporting scheme. What is even more interesting is that you can interconnect financial reporting schemes.

If the more detailed explanation makes sense, be sure to stay tuned for more information that is forthcoming related to accounting, reporting, auditing, and analysis in the Fourth Industrial Revolution.

Terms tend to be nouns. Associations tend to be verbs.

Reader Comments