BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from February 1, 2019 - February 28, 2019

Logical Theory Describing a Business Report

A logical theory defines and describes things. Details must be explained to brainless robots. Once you define things you can ask questions. Interestingly, the discipline of describing something in a form a computer algorithm can understand assists you in understanding the world better, weeding out myths and misconceptions.

Several years ago Rene van Egmond and I wrote a logical theory which describes a financial report, Financial Report Semantics and Dynamics Theory.

We used that base, removed everything related to the domain of financial reporting (which is a specialization of a business report), and now we have a Logical Theory Describing a Business Report (the more general use case).

There really are very few differences. One difference is that a financial report has "disclosures". The equivalent in a business report is a "fact set".

A logical theory is an excellent communications tool. In order to get a software engineer or a team of software engineers to be able to work together and build the right software, a logical theory is very helpful.

If anyone has any feedback, please send it. Always looking for ways to improve!

Case for XBRL-based General Purpose Financial Reporting on One Slide

Financial reporting has a direct link to the well being of society. The world needs a digital alternative to the paper-based or "e-paper" general purpose financial report. The following is a summary for the case for XBRL-based general purpose financial reporting summarized on one slide:

(Click image for a larger view)

A general purpose financial report is a high-fidelity, high-resolution, high-quality information exchange mechanism. That mechanism has historically used the media of "paper". Over the past 50 years or so, that paper-based mechanism has given way to a new mechanism, "e-paper". By "e-paper" I mean PDF documents, HTML documents, Word documents and such.

XBRL is a new media, a new mechanism for creating a general purpose financial report. XBRL is a high-fidelity, high-resolution information exchange media that allows for the creation of high-quality financial reports. Those reports can be read by human-based processes as before but because of their structured nature are also effectively readable by machine-based processes.

And oh, XBRL is great for special purpose financial reports also.

If you don't understand how this would work, read Computer Empathy and maybe Financial Tansformation and the Modern Finance Platform. If you want to understand how to implement this, read Method of Implementing a Standard Digital Financial Report Using the XBRL Syntax and this step-by-step example of that method.

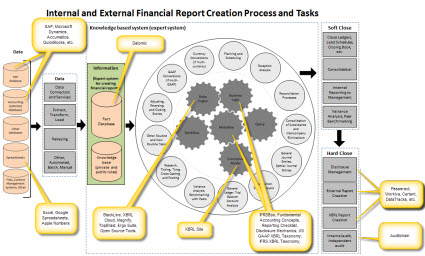

Here is a graphic that shows more details about the tasks involved in creating a financial report:

(Click image for larger view)

Digital Financial Reporting Conformance Suite

This page is set up to accumulate sets of XBRL instances, related XBRL taxonomies, XBRL Formulas, and other such technical artifacts that make up an XBRL-based digital financial report. This digital financial reporting conformance suite supports the Method of Implementing a Standard Digital Financial Report Using the XBRL Syntax, Open Source Framework for Implementing XBRL-based Digital Financial Reporting, and Accounting Process Automation XBRL Application Profile.

The goal of this conformance suite is to enable software engineers to create high-quality XBRL-based information for use internally for accounting process automation projects or for XBRL-based reporting where quality matters.

This is currently a work in progress:

- Positive Examples: This contains a link to an RSS feed that has either (a) a link to another RSS feed that has a set of positive examples of an XBRL instance and related taxonomies and linkbases (like this) or (b) direct reference to an XBRL instance and related taxonomies and linkbases (like this). All of these are POSITIVE EXAMPLES meaning that you should find no errors. Each of these XBRL instances and related XBRL taxonomies have been tested against three different XBRL software applications each of which reports no errors. (While it is conceivably possible that you find an error, it is highly unlikely. If you do find an error, check to make sure that you do not have a bug in your application. If you believe that the error is mine, please contact me and I will investigate. If I do confirm that I have an error, I will fix the error.)

- Positive and Negative Examples: This conformance suite is set up identical to the XBRL International conformance suites. It has both POSTIVE examples and NEGATIVE or contra-examples.

This are the results of the positive examples for one software vendor

These are the results of the positive and negative examples for one software vendor.