BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from November 1, 2010 - November 30, 2010

Ventana: Need for Automation in Creation of SEC XBRL Filings

Ventana Research, in their article XBRL Filing Errors Point to Need for Automation through Technology, points out the need for automation in the process used to create SEC XBRL filings. I agree with Ventana and would go on to say that if one does not have automation then one needs hefty validation in order to detect and correct errors caused by using humans in the process.

The Ventana Research article points to an SEC Staff Observationwhich communicates the results of a review the Commission's Division of Risk, Strategy and Financial Innovation performed. In that review, the SEC staff points out common classes of errors found in SEC XBRL filings.

When one thinks about it, the ultimate test of an SEC XBRL filing is using that filing within some analysis process. Simply comparing two filings from different SEC filers will do the trick.

I will point out two resources which can help you figure out the types of errors you will have to deal with. The first is a model SEC XBRL filing. In particular, this PDFwhich explains the details of the simple filing, helps you see the information integrity issues you need to be sure to watch over. See the notes in that PDF for information.

The second resource is what I call the comparison example. This has three fairly basic sample financial statements. The statements have both positive and negative examples. One thing this shows is the very negative impact of filers creating their own concepts where a concept in the GAAP taxonomy should exist.

The issues SEC filers are bumping into are not all of their own making. Many of the issues come from issues with the US GAAP Taxonomy itself and lack of clarity in the SEC XBRL filing rules.

Like I said above, trying to analyze company information in those SEC XBRL filings is the ultimate test. This is not to say that everything is, or even should be, comparable. This will start the conversation where those in the financial reporting supply chain will discuss these sorts of issues.

Edgar Online and UBmatrix Merger Completed

UBmatrix is now part of Edgar Online: EDGAR Online and UBmatrix Complete Merger to Create Global XBRL Leader in Filing Creation Services, Data Products, and Software.

Harvard Business School: The Landscape of Integrated Reporting

Harvard Business School held a workshop, A Workshop on Integrated Reporting: Frameworks and Action Plan. As part of that workshop an eBook, The Landscape of Integrated Reporting, Reflections and Next Steps, was made available.

The executive summary of the workshop provides the following conference overview:

Business has lost society’s trust and must act to restore it. One way to do so is through ideas and processes that demonstrate that business cares about more than just profit. Integrated reporting is a way to show society that business cares, is holding itself accountable, and is measuring itself on matters that society cares about.

While perhaps a bit ahead of the curve, the timing is right to be holding this conversation and the topic is of great importance. Harvard Business School is committed to this subject, which is reflected in HBS’s own reporting efforts and by supporting this workshop.

The book is a collection of papers submitted to the conference and provides a summary of the current thinking on integrated reporting. The book is packed with information, about 334.

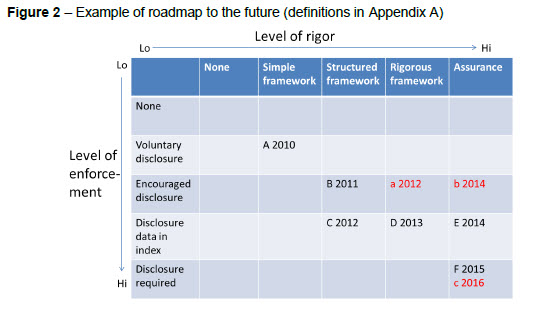

One of the interesting things in the ebook is this graphic (from page 324) which provides an example road map to the future. The graphic shows an evolution of the framework. The reason the graphic is interesting to me as it explains the process we are going through with SEC XBRL filings.

I like the way it shows an evolution from nothing, to a simple framework, to a structured framework, to a more rigorous framework, and then throwing in assurance.

In my view, that is similar to what is going on with SEC XBRL filings right now. We went from no XBRL filings, to a simple US GAAP taxonomy and a simple filing framework and XBRL instances. We learned from that. I think we are still in that simple framework level currently.

Over the coming years we will evolve to a more structured and rigorous US GAAP Taxonomy and SEC XBRL filings. A lot has been learned in the past couple of years; this will contribute to a more structured an rigorous, and therefore more useful, set of SEC XBRL filings.

Gartner: The 21st Century Disclosure Initiative Will Reprioritize Your BI and PM Strategies

This is a great Gartner research report: The 21st Century Disclosure Initiative will Reprioritize Your Business Intelligence and Performance Management Strategies. The punch line is:

Publicly traded companies should use these regulatory reforms to gain a competitive advantage, rather than treat them as a cost of doing business.

The research report discusses how the "last mile of finance" will change, the benefits of the change, and approaches to implementing these changes within your organization.

In my view these changes will not be limited to public companies. Private companies reporting to their financial institutions in support of commercial loans is the obvious next step.

Further, the report points out the benefits structured data provides internal information systems.

Many people make the mistake of asking, "What it costs to add XBRL to a business report." The equation has two parts: cost and benefit. Another logical question one might ask is, "What is the cost of not having XBRL tagged business information." As more and more information becomes available in an XBRL format, comparing the true costs and benefits will become easier.

As these net benefits are seen, more and more organizations will realize that the "outsource" and "bolt-on" options are less favorable than an embedded or integrated approach to implementing XBRL. Perhaps not for everyone, but for many.

Playing with the Firefox XBRL Viewer Add On

I have been playing around with the Firefox XBRL Viewer add on. There are lots of documents one can fiddle with on this RSS feed.

But the most interesting XBRL instance I am seeing is the SEC Model that I created. You can get to that document here: http://xbrl.squarespace.com/storage/secmodel/2010-11-01/abc-20101231.xml.

While the viewer leaves a lot to be desired, it does provide very good clues what working with XBRL will be like some day.

One particularly good feature of this Firefox XBRL Viewer add on is the ability to jump between hypercubes. To try this using the SEC XBRL Model filing:

- Load the XBRL instance above by pasting it into your Firefox browser (after you install the add on).

- Go to the balance sheet (104000 - Statement - Statement of Financial Position, Classified) Network.

- Go to the line item on the balance sheet "Common Stock, Value, Issued".

- Click on that concept and a dialog box appears.

- Click on the funky looking link which reads http://www.abc.com/role/ClassesOfCommonStock

- Notice how you jump to a new hypercube!

You can try the same thing for a number of other hypercubes which are connected to each other. That was one of the points of the SEC XBRL Model filing, to point out these sorts of connections.

The fact that you can navigate from one hypercube (referred to as [Table]s in the US GAAP Taxonomy) will help people creating taxonomies to construct better taxonomies (i.e. with these relations properly articulated). It will also help business users grasp the value of XBRL.

Experiment with some of the other XBRL instances in that RSS feed. Each document is there for a reason.

Imagine when:

- You can combine two or more XBRL instances, say for several SEC XBRL filings and be able to compare them using a tool like this dynamic Firefox XBRL Viewer.

- You can do this sort of slicing and dicing in Excel, leveraging Excels features to move information around and XBRL's features to automatically grab information from business reports of all sorts.

- You can create XBRL instances and XBRL taxonomies using an interface similar to the Firefox add on.

If you have not fiddled around with the Firefox add on, I would encourage you to do so.