BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from November 1, 2012 - November 30, 2012

Simple Knowledge Organization System (SKOS)

This metadata stuff keeps getting more and more interesting. A post I made to the LinkedIn group Semantic XBRLled to someone mentioning SKOS.

SKOS, or Simple Knowledge Organization System is a standard way to express metadata. A W3C recommentation, is described this way by an introduction to SKOS:

SKOS provides a standard way to represent knowledge organization systems using the Resource Description Framework (RDF). Encoding this information in RDF allows it to be passed between computer applications in an interoperable way.

Using RDF also allows knowledge organization systems to be used in distributed, decentralised metadata applications. Decentralised metadata is becoming a typical scenario, where service providers want to add value to metadata harvested from multiple sources.

Here is a SKOS primer. Here is a SKOS wiki. Here is an introduction to SKOS provided by XML.COM. Here is a SKOS reader. RDF-Gravity reader.

This is how I see it. You can express metadata using any ole XML. But, there is leverage if you not only use XML, but rather use the standard such as RDF/OWL. But even using RDF/OWL you have a lot of flexibility as to how to express things. SKOS provides an even higher level standard than RDF/OWL for the specific purpose of expressing metadata used in knowledge management systems.

So I used RDF/OWL to express the major categories, topics, disclosure objects, and disclosure templates used for some things I am trying to achieve relating to financial reporting using US GAAP. Here is that metadata.

Seems that following the SKOS standard provides an even higher level of possible interoperability. Could be wrong, but SKOS seems like the way to go, a standard form of RDF/OWL for the sort of metadata I need to model.

Semantic Equivalence

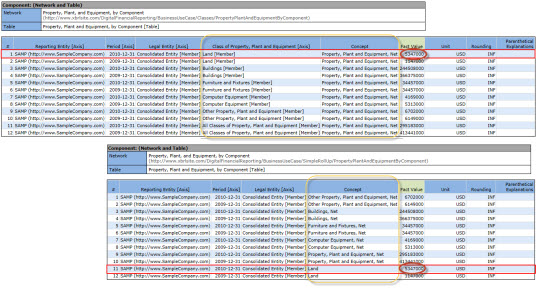

The screen shot below shows a visual representation of the fact tables of two XBRL instances/XBRL taxonomies.

The top fact table representation comes from the XBRL instance/XBRL taxonomy example in the business use case "Classes" and models the components of PPE as the [Member]s of an [Axis] (using US GAAP taxonomy lingo) or dimensions of one primary item (using XBRL Dimensions lingo).

The bottom fact table representation comes from the XBRL instance/XBRL taxonomy example in the business use cases "Simple Roll Up" and models the components of PPE as concepts within a set of [Line Items] (using US GAAP taxonomy lingo) or primary items (using XBRL Dimensions lingo).

Are the two facts which express the fact value of "Land" semantically equivalent?

You probably answered "YES". That is the answer which I would have given. While syntactically the two facts are modeled using different approaches; semantically they say the same thing. (If you don't agree that the answer is YES, I would enjoy hearing your rational.)

So, if they are semantically equivalent; can you just take the fact in line #1 on the top fact table out and replace it with #11 from the bottom fact table? Of course you cannot because the modeling approach of the top fact table and the modeling approach of the bottom fact table are different.

Neither modeling approach is wrong. However, approaches must not be arbitrarily mixed.

Yet this is a common mistake in modeling SEC XBRL financial filings which I have seen. One of the areas where this appears the most is the modeling of classes of preferred and common stock. Mixing these approaches causes things like balance sheets which do not balance.

Something which this brings up is how do you know whichmodeling approach to use? That is a good question. Sometimes you don't really have a choice because if you are either extending an existing model or fitting another piece into some other model you need to fit your modeling into that existing model. Other times there is no clear answer. For example, in the US GAAP taxonomy sometimes both approaches are modeled and it can be confusing which to use if there are no other constraints to consider.