BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from December 2, 2012 - December 8, 2012

SEC Calls Again for Corrections in XBRL Filings

SEC Calls Again for Corrections in XBRL Filings.

Patience with repetitive, simple errors in XBRL filings is wearing thin at the Securities and Exchange Commission.

“Limited liability applies only to filers who make good faith efforts to comply with the rules and who promptly correct errors when they are made aware of them.”

“They have widespread skepticism about the reliability or usability of the data,” she said, in part because they see how commonly it contains errors. “It harms their ability to analyze your companies accurately.”

One Global Approach to Digital Financial Reporting?

Will there ever be one global approach to digital financial reporting? That is a good question.

The International Journal of Digital Accounting Research published an article, XBRL and Integrated Reporting: The Spanish Accounting Association Taxonomy Approach, which contemplates that issue.

That document pushes "the data point model" approach to modeling information. There are other approaches. Here is a summary of approaches which I am aware of:

- Data point model

- SEC/US GAAP Taxonomy model (Used by SEC in the US)

- Inline XBRL (Used by HM Revenue and Customs in the UK)

- SBR (Standard Business Reporting, used by The Netherlands and Australian governments)

- MCA India

- Japan FSA

- The Global Filing Manual (don't know how this is going)

- FINREP

- Other more proprietary approaches (like the FDIC)

Would one standard, global model for digital financial reporting be a good thing? I think so. Is it necessary? It may not be necessary, but it sure could not hurt. I don't really know the complete list of pros and cons.

It will be interesting to see how this plays out.

XBRL Formula Processors Seem Very Interoperable

I believe that I have done the work necessary to finally convince myself that XBRL Formula processors are inter operable. I had my doubts for the past three years; but it seems that most of the interoperability issues I was running up against were due to (a) my lack of technical skills (b) poor validation messages from software (c) inconsistent validation messages (d) a few missing conformance suite tests.

As such, I can say that I have personally run or had someone else I know and trust run my reference implementation through the following XBRL processors and each return no validation errors and otherwise appear to provide exactly the same results:

- UBmatrix XPE (4.0)

- XBRL Cloud (web service)

- XBRL Cloud (XRun)

- Fujitsu

- DecisionSoft TrueNorth

- Reporting Standards

- Arelle (Open Source XBRL processor)

(If there are any other XBRL processors out there which also have XBRL Formula processing capabilities, please contact me and I would gladly test to see if your results are consistent with the results above.)

The reference implementation (of an SEC XBRL financial filing) is very comprehensive and built to exercise XBRL processors. I have 122 assertions which exercise every computation in the XBRL instance plus other business rules. I have working prototypes of US GAAP Domain level, Industry/Activity level, reporting entity level, and reportability/consistency business rules.

I hold these XBRL Formula example files out as excellent examples of how to construct business rules which are necessary to support and prove that you have correctly created your XBRL taxonomy and XBRL instance. These XBRL Formulas are the "glue" which hold your digital financial report together. If you look at the Verification Summary of the XBRL Cloud Evidence Package it is hard to dispute that these business rules are necessary to make sure something like an SEC XBRL financial filings is created correctly. Well, I guess you can always eye-ball this and manually check to see if you got all this stuff correct; but it has been my experience that manually testing this does not work out so well. Automated testing using business rules expressed using XBRL Formula is much more effective and efficient.

There is one specific enhancement to these XBRL Formulas worth pointing out. I am now using the very handy <msg:message>, be sure to take a look at that. You can see examples in this file.

If you want to experiment with XBRL Formulas and you are persistent, try the Arelle XBRL processor. It is open source, totally free.

I predict that 2013 will be the year people start to understand business rules. Get a jump on the herd! Start learning about business rules now. Don't believe that business users are ever going to have to deal with all that ugly XBRL Formula syntax. They won't. But they will need business rules to get their filings correct.

Updated Metapattern Visualizations, Easier to Understand XBRL

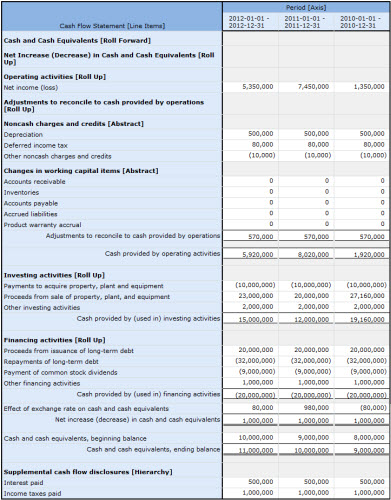

I have been able to update the visual examples of the financial reporting metapatterns thanks to XBRL Cloud. The folks at XBRL Cloud have allowed me to provide an "Evidence Package" for each of the metapatterns. For example, here is the visualization of the "Roll Forward" metapattern.

You can get to information for all the metapatterns here on the Digital Financial Reporting Wiki. This documentation explains each metapattern.

Remember that these metapatterns are the foundation upon which pretty much any XBRL-based digital financial report are based. Understanding these helps you get your head around pretty much any digital financial report. These human readable visualizations help you get your head around the metapatterns.

For more information about the XBRL Cloud Evidence Package and why it is so useful, please refer to this blog post.

Reporting Templates: Key to Ease of Use and SEC Data Quality

Reporting templates are the key to easier to use XBRL-based digital financial reports and usable SEC XBRL financial report information within the EDGAR system.

The article on Disclosure Management mentions reporting templates (see page 5). I created a set of 75 reporting templates which I called "disclosure templates". In the past I have referred to these as "exemplars" and "prototypes". Here is a set of 291 SEC XBRL financial reports broken down by component where you can compare how different reporting entities modeled similar pieces of their financial report. In essence the entire SEC EDGAR system is a big set of reporting templates. The AICPA even has a publication, Accounting Trends and Techniques, which is basically reporting templates gleaned from 600 SEC filings printed into a book.

ResearchPoint-XBRL from Softpark is held out to be a set of pre-validated templates for creating financial filings to comply with the India Ministry of Corporate Affairs (MCA), they say, "Finally, you can now do MCA filings much faster and without pain."

SQLPower says that they also offer reporting templates called "superVision" per a post on LinkedIn.

So what exactly is a reporting template and why is it useful?

The XBRL Cloud Evidence Package (which I mentioned in another blog post) helps you see what a reporting template is and why they are useful. For example, consider a cash flow statement. A reporting template is basically a model of the cash flow statement. It includes the rendering, an SEC preview, the model structure, its fact table, all tightly woven together by a set of business rules and general modeling and other verification rules.

There are some other things which you cannot see. Consider the rendering:

The rendering is simply the model structure, the fact table, and some rendering algorithms which organizes the information in a manner familiar to accountants and other business users. For example, three periods are shown, each in a column.

Pay particular attention to the business rules of the reporting template. Take a close look at the business rules and see that every numeric computation is represented in those rules. The business rules make it impossible to make a mathematical error. In fact, all the automated verification rules are simply information a software application can use to make sure the user of that software cannot do something illogical or illegal.

The verification is not done at the end of the process; verification is done throughout the process, by the software, to make sure the business user stays on track.

Creating something like an SEC XBRL financial report involves steps such as:

- Selecting a reporting template from a library of reporting templates organized by industry, by Accounting Standards Codification (ASC) topic, or maybe just a list of disclosures. (FYI, the SEC EDGAR system now has thousands of XBRL filings and is now a big reporting template library similar to the AICPA's Accounting Trends and Techniques except that it doesn't only contain 600 companies, it contains 8000 companies.)

- Adding that reporting template to your report creation project. The reporting template is a rock-solid, valid piece of a report...but it is not exactly how you want it.

- You edit the template, adding additional characteristics that you need, removing the ones you don't, putting the information you want to report into that reporting template. Throughout the process the software keeps everything connected together logically and legally.

- Accountants use their expertise and judgment to be sure the things that the software cannot check are done correctly. For example, software cannot tell you if you picked exactly the right concept. The software can help you make sure you did not pick the wrong concept though. Say you put an income statement concept on the balance sheet; lots of ways the software can help you realize that you made a mistake.

Just like Microsoft PowerPoint helps you drag shapes and other objects into your presentation or Microsoft Visio helps you create a nice drawing, both using templates; reporting templates help your disclosure management software help you create great financial reports.

All this may be hard to believe, but if you think about it you will see that it makes sense. Disclosure management software works with pieces of information, weaving them together how you want them weaved together. Call it "structured authoring" or "model-based authoring" or "semantic authoring" or digital financial reporting or disclosure management. They are all really the same thing.

I predict you will start seeing disclosure management software which works in this manner within twelve months. Then, the new paradigm of financial reporting will really take off.

These reporting templates will also contribute to the quality of the SEC XBRL financial filings in the SEC EDGAR system. Clearly if the reported information is better, the XBRL in the SEC EDGAR system will improve. The better the business rules, the better the information in those SEC XBRL financial filings.

Do you think I am dreaming? Do you have other ideas? Leave a comment.