BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from December 14, 2014 - December 20, 2014

Christmas Present from SECXBRL.info

SECXBRL.info provided a nice little Christmas present. Three actually.

The first is that they now support human readable renderings of report components rather than simply the machine readable information. Here is a basic example. Here is a list of the components of an entire filing, click on any link in the "Spreadsheet" column.

The second is an HTML format for pretty much every query. So, rather than viewing things in their interface you can view them as HTML pages. Here is a list of the DOW 30. Here is a list of the Fortune 100. Here is a list of the S&P 500. Here is a list of the Russell 1000.

The third present is a token which provides access to their API until January 15, 2015. Here is a link to their API which has the token embedded. (I don't know what sort of limitations they have on the token.)

Digital financial reporting is coming along nicely! Merry Christmas to all!!!

Disclosure Error Rate Consistent with Primary Financial Statements Error Rate

I have spent a good amount of time studying the primary financial statement information from XBRL-based digital financial reports submitted by public companies to the SEC. I have examined the relations between the fundamental accounting concepts on the primary financial statements. I have examined the fundamental ability to read any reported information, what I call the minimum criteria.

But what about the disclosures? Well, I have been looking at those also. Not in as much detail as the primary financial statements at this point, but now that I have a really good handle on the primary financial statements, I will dig into the disclosures more.

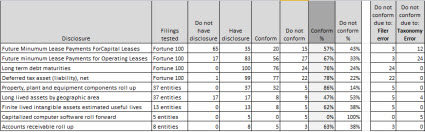

This is a summary of what I see right now. Below are summaries of the analysis of 9 fairly basic disclosures. I provide the name, a link to the analysis summary, and a percentage of SEC XBRL financial filings which conform to what I would expect the disclosure to look like:

- Future miniumum lease payments for capital leases: 57%

- Future minimum lease payments for operating leases: 67%

- Long term debt maturities: 76%

- Deferred tax asset (liability), Net: 78%

- Property, plant and equipment components roll up: 86%

- Long lived assets by geographic area: 47%

- Finite lived intangible assets estimated useful lives: 62%

- Capitalized computer software roll forward: 0%

- Accounts receivable roll up: 63%

Here is a table of this information:

Clearly this is not conforming to formal scientific protocol, but I do think that it provides a reasonably good assessment of how well disclosures are being created. What I see is that the quality of at least these basic disclosures is fairly consistent with the quality of the primary financial statements. While the above 9 are samples of the total population, the primary financial statements analysis was of the entire population.

Conformance to the fundamental accounting concepts is about 60% for the entire population of SEC filers (excluding funds, trusts, and inactive filers). Conformance to the minimum criteria is about 57% for that same entire population. From what I can see in the conformance percentages above, it looks like disclosures are in the ball park of the fundamental accounting concepts and minimum criteria, let us just say 50 to 60% or so.

The most interesting thing though is that the testing "rig" that I used to test the fundamental accounting concepts works on the disclosures also.

If you look through the links in the list above you see a lot of PDFs which were manually created piece-by-piece by looking at individual SEC XBRL financial filings. But then you see this. Basically, I learned from creating and perfecting the PDFs. I applied what I learned and created far, far more automated process for analyzing the disclosures.

If you follow my blog you will likely recall my mantra:

The only way a meaningful exchange of information can occur is the prior existence of agreed upon technical syntax rules, domain semantics rules, and workflow/process rules.

What I am realizing from doing all this work analyzing public company XBRL-based filings to the SEC is the low probability that the FASB or SEC or anyone else would be able to come up with all those rules proactively, in advance of having thousands of filings to look at using machine based processes. Who would have known all of the rules which would have been needed? While I thought I did, I realize now that I only had a partial set of understanding.

What will reveal the complete set is automated testing of digital financial reports which need to be created are the inconsistencies observed in SEC filings. This is actually consistent with what happened back in 2004. What happened then was the creation of the XBRL 2.1 conformance suite. Before the conformance suite was created, software had an interoperability problem. During and after the creation of the conformance suite most of the interoperability issues went away. For example, if you go look at #1 Technical syntax readable in the minimum criteria, you see that there is only 1 error in about 7000 filings. That is the "technical syntax rules" in my mantra above being satisfied.

All these tests like the fundamental accounting concepts and relations between concepts and the disclosure rules which are basically more detailed fundamental concepts and relations-type information. Rules. Here is the summary of the results. What drives that? Well, here are the mapping rules. Here are the impute rules.

Basically, imagine a battery of domain semantic tests (second part of the mantra):

- Minimum criteria type rules

- Fundamental accounting concepts and relations between concepts type rules

- Rules for defining the classes or categories into which every taxonomy concept fits

- Rules for defining the relations between classes or categories and the members of those classes

- Applying all of the above to the set of possible disclosures (this is a prototype of this information for about 226 disclosures, this is another prototype with about 500 disclosures, this is a vetted prototype of the complete list of disclosures organized within topics)

This is some of the basic knowledge of financial reporting. This is all mechanical type stuff. No judgment involved here. All this information will eventually be in machine readable for so software can use it to help get these mechanical pieces of digital financial reports correct.

This set of slides, Machine Readable Knowledge Representation Using XBRL for Digital Financial Reporting, summarizes all this as best as I can right now.

Digital financial reporting is just around the corner.