BLOG: Digital Financial Reporting

This is a blog for information relating to digital financial reporting. This blog is basically my "lab notebook" for experimenting and learning about XBRL-based digital financial reporting. This is my brain storming platform. This is where I think out loud (i.e. publicly) about digital financial reporting. This information is for innovators and early adopters who are ushering in a new era of accounting, reporting, auditing, and analysis in a digital environment.

Much of the information contained in this blog is synthasized, summarized, condensed, better organized and articulated in my book XBRL for Dummies and in the chapters of Intelligent XBRL-based Digital Financial Reporting. If you have any questions, feel free to contact me.

Entries from February 22, 2015 - February 28, 2015

Please Help if you Can: Convert XBRL into RDF/OWL 2 DL

I have spent literally hours trying to convert an XBRL-based digital financial report into RDF/OWL 2 DL with limited success. If you know how to do this, any help would be greatly appreciated.

This will walk you through the XBRL-based report, to the XML Infoset of the semantics of the information, to what I have been able to create thus far:

- Reference Implementation: I created what I call a reference implementation of an XBRL-based digital financial report. You can see the XBRL instance which is the entry point of the report. Load that document and the supporting taxonomy will be loaded. If you want to see a human readable rendering of that report, use this evidence package provided by XBRL Cloud.

- Fact Table Infoset: You DO NOT want to convert the XBRL syntax to RDF/OWL 2 DL. What you want to convert is the meaning of the information. The Fact Table Infoset is generated from the XBRL instance. THAT is what needs to be converted to RDF/OWL 2 DL. The hard part is converting the XBRL into the XML Infoset format.

- Model Structure Infoset: The Model Structure Infoset is likewise pre-converted from XBRL to an Infoset which represents the XBRL taxonomy structure. There are some pieces missing for a complete conversion, but this provides enough to create a useful conversion.

- OWL 2 DL Ontology: This is where I have gotten so far in terms of creating an ontology which is used to express the relations in the report.

- RDF for Fact Table: This is the RDF for the Fact Table Infoset information. Basically, this RDF and the Fact Table Infoset should be equivalent in terms of meaning.

- RDF for Model Structure: This is in the worst shape. This is the RDF for the Model Structure Infoset. I am trying something that I saw, it is probably not a good idea; and it may not even be allowed. I am trying to nest the rdf:Descriptions. I have seen that done by others, but again; not sure if this is legal or a good idea. Anyway, this is in pretty bad shape.

- Business rules: (EXTRA CREDIT)If you are REALLY agressive and want extra credit points; these are business rules for the XBRL instance which likewise need to be converted into RDF or OWL or SWRL or something. I am not even sure this is possible. Again, this is EXTRA CREDIT. The Fact Table Infoset is the first priority, then the Model Structure Infoset.

The goal is to convert an entire XBRL-based digital financial report into an RDF + OWL 2 DL + SAFE SWRL-based digital financial report. The reason is to see the pros and cons of each format.

What I am seeing thus far is that RDF is brutal to work with. There are a zillion different formats. There is no nesting within the RDF which (a) makes the information incredibly flexible (which is a good thing) but it makes the RDF harder to read in software if you are not very good at writing software (like me).

Something that I have learned already in this process is that many software developers don't really get RDF. This document, Why RDF is More than XML, walks you through some issues. Basically, XML tools don't work very well with RDF because RDF is looks flat. What is really going on is that RDF is flexible and makes querying easier. While I would agree that there are situations when you work with XML and you need the hierarchy if you are a human working with the XML. But, computers can work with RDF just fine. There might be somewhat of a compromise, a simplified syntax for RDF or more of a shorthand.

The bottom line on all of this is that syntax does not matter. One should be able to convert from XBRL to RDF + OWL 2 DL. What I am trying to figure out is what you get from off-the-shelf OWL validators or reasoners.

My intuition tells me that neither off-the-shelf XBRL tools nor off-the-shelf OWL tools will serve the needs of business professionals appropriately, particularly accounting professionals. Hybrid combination tools and digital financial reporting specific tools are what is necessary.

US GAAP XBRL Taxonomy Missing Approximately 50% of Level 3 Text Blocks

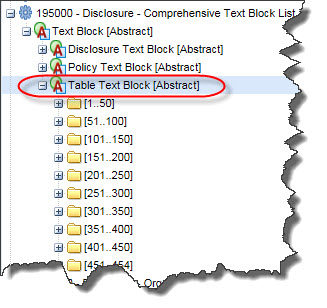

The US GAAP XBRL Taxonomy provides 454 Level 3 Text Blocks. In the taxonomy these are called [Table Text Block]s. These Text Blocks are used to provide human readable HTML for a specific disclosure. You can find a list of these Level 3 Text Blocks in the Comprehensive Text Block List in the US GAAP XBRL Taxonomy.

(Click on image to go to US GAAP XBRL Taxonomy)

(Click on image to go to US GAAP XBRL Taxonomy)

The US GAAP XBRL Taxonomy and SEC EFM use inconsistent terminology, so it is worth making sure we are on the same page here. What the US GAAP XBRL Taxonomy calls a "Disclosure Text Block", the SEC calls a "Level 1 Text Block" or a "Footnote as a Text Block". Level 2 Text Blocks are policies. Level 3 Text Blocks provide human readable HTML at the level of an individual disclosure. And finally, Level 4 Detail provides individual detailed facts for an individual disclosure. All this is explained in the SEC Edgar Filer Manual (EFM) section 6.7.12.

And so, the US GAAP XBRL Taxonomy says that there are 454 possible disclosures because they provide 454 Level 3 Text blocks ([Table Text Block]s).

Well, I went through the US GAAP XBRL Taxonomy and tried to identify each individual disclosure and I came up with about 957 total disclosures. That number includes a handful of statements, 129 Level 1 Text Blocks (Note Level), a handful of Level 2 Text Blocks (Policy Level), and a few odds-and-ends which really are not individual disclosures. As such, I will adjust the total number of true disclosures down to this approximate number: 807.

I will also point out that my list includes only disclosures for commercial and industrial companies. I am not including disclosures for banks, insurance companies, broker-dealers, and so on.

And so the US GAAP XBRL Taxonomy indicates that there are 454 disclosures, I can point out about 807. It is my guess that my list of 807 disclosures is off by between 50% and 100%. That is just an educated guess, hard to come up with an exact number without going through every public company filing and trying to identify every disclosure (which I am working on now). But my guess is based on work trying to determine all the different types of primary financial statements (what I call report frames, this document helps you understand report frames).

There is a relationship between the Level 3 Text Block and Level 4 Detail disclosures. Look at three examples which I created for fairly common disclosures:

- Inventory, Net: Roll up of the components of inventory.

- Property, plant and equipment components: Roll up of the components of PPE.

- Long-term debt maturities: Roll up of the maturities schedule of long-term debt.

Looking at rather uncommon disclosures also points out that text blocks are missing from the US GAAP XBRL Taxonomy. Here is an example:

- Capitalized Computer Software Roll Forward: Roll forward of capitalized computer software.

Looking at both the Level 3 Text Blocks and the Level 4 Detail for disclosures helps you understand if pieces are missing from the US GAAP XBRL Taxonomy.